The more analysts covering a stock the better the quality of information about the stock, right? WRONG!

The paper highlighted this week, from Nianhang Xu, Xianyu Jiang, Shinong Wu and Kam C. Chan of the Renmin, Central University of Finance and Economics and West Kentucky universities, is the first study to address the question ‘Is there a relationship between analysts herding and future stock price crashes?’; there is.

The more analysts covering a stock and the closer their forecasts, the more likely it is the stock price will crash in future. The main reason seems to be that analysts are always quick with and happy to share good news; but they tend to hold back bad news. The more of them covering a stock the less likely it is one will break ranks.

Held behind a levy of silence bad news builds up unreported until one day the levy breaks, the market is then flooded with bad news and the stock price crashes. Investors in Chinese ‘new-economy’ stocks should take particular note.

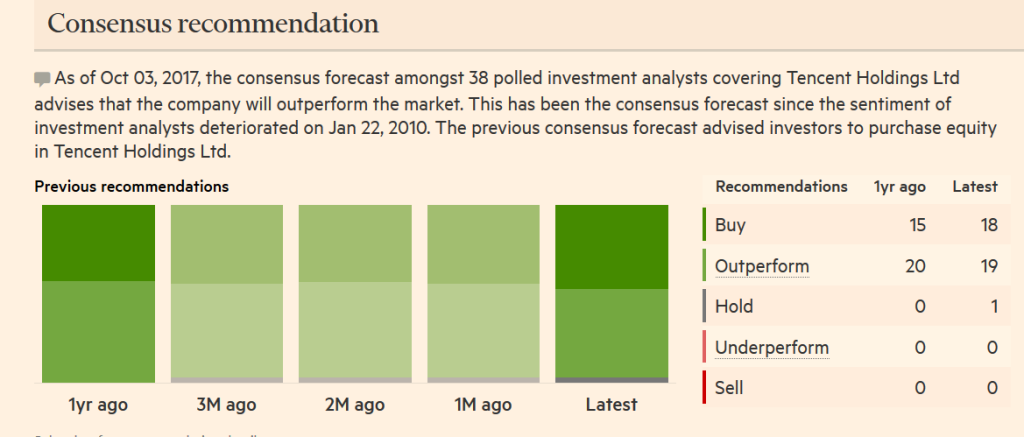

Wonder who the ‘hero’ with the Hold recommendation here is? They might be worth talking to…

Wonder who the ‘hero’ with the Hold recommendation here is? They might be worth talking to…

You can follow this link to the paper in full Analyst Herding.

Happy Sunday.