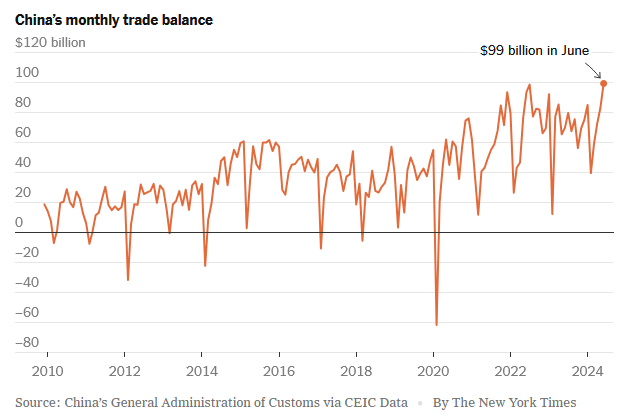

The U.S. decided in 2017 to clip China’s wings as an export manufacturing powerhouse. Since then China’s trade balance has gotten a lot bigger. In June it reached a new record.

So what’s going on? Trang Hoang and Gordon Lewis, researchers at the FED, have twigged part of the answer which they discuss in a short paper linked to here As the U.S. Is Derisking.

They don’t dwell on the implications of this but I’d say, from a U.S. policy-maker’s point of view, they’re alarming.

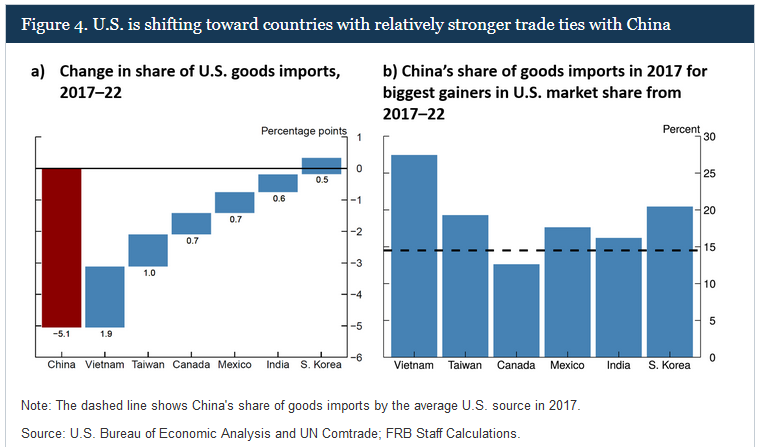

What’s happened since 2017 is China’s share of U.S. goods imports has fallen, sure enough. At the same time though China’s share of imports to the countries the U.S. has preferred has gone up.

In a nutshell, what the U.S. has achieved is no weakening of China’s export manufacturing money maker, in fact it’s encouraged its development.

It gets worse. In the process greater economic interdependence with China has been fostered with the U.S.-friendly export manufacturers. Thus, a China-Mutual-Prosperity-Complex (CMPC) has been strengthened over which America has little control (and China, de facto, does).

If the Fed has noticed State Department and White House related wonks are likely on to this too. No more direct tariffs for China would be the obvious sensible response.

The final point to note is the researchers find no evidence of Chinese goods being sneaked in through the back door of any of the CMPC. The gains then are very real and likely to represent a permanent shift in China’s favor and influence with these ever-closer partners.

In order to significantly undermine China’s status as the world’s premier manufacturing platform Americans could of course be encouraged not to fill basements, attics and garages with so much ‘stuff’ [Junk? Ed.]. 🙂 Sorry, what was I thinking!

Happy Sunday.