James Laurenceson, Director and Professor at the Australia-China Relations Institute at the University of Technology Sydney takes a look at the Australia-China trade relationship in the context of calls for the Australian government to more assertively intervene and help out Australian business.

The key points:

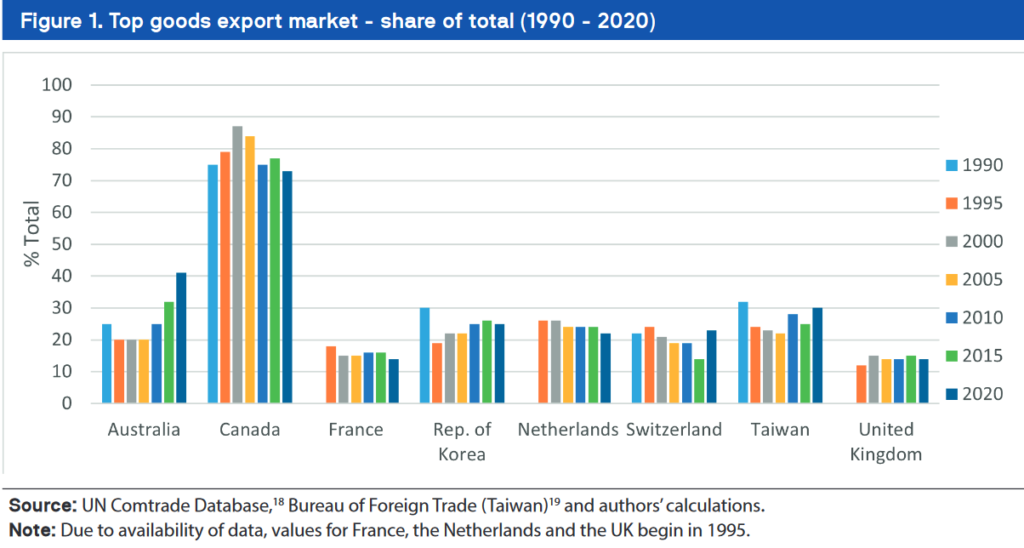

1. Contrary to popular opinion Australia has not foolishly let itself become exposed to a single market turning a trade opportunity into a strategic liability. Most medium sized economies end up with roughly the same skew in terms of concentrated trading partner relationships. Viz.

2. The recent blip-up in the Australian numbers is nearly all an iron ore story. Iron ore has significantly increased in price in the last couple of years and is not on the list of products China has targeted for import/export disruption. Thus, “..the PRC’s continuing demand for iron ore pushed the total value of Australia goods exports to the PRC steadily higher from September 2020 and throughout 2021. Despite ongoing bilateral political tensions and the breaking down of the firewall between politics and trade last year, the total value of Australia’s goods exports to the PRC in the first half of 2021 was 36 percent higher than the previous record set in 2019. Even today, the annual value of goods exports to the PRC is worth 3.8 times that to Japan, Australia’s second largest international customer.” [My bold]

3. Of the products singled out by China the paper goes through each in turn (starting from P. 8). Looking more closely at: barley, beef, coal, cotton, timber, rock lobster, copper and wine, disruption is clear. However, the extent of ‘losses’ varies as all of these products are produced by wily private sector operators who have done a good job in finding, where possible, substitute markets. Sure, there’s a hit; but the size appears small and may shrink further when COVID-affected supply chains are recovered.

In conclusion the author finds no evidence of a crippling effect to either the Australian economy as a whole or specific industries in general. As a result there’s no pressing need for the Australian government to step in and ‘do-something’ as the private sector seems to be doing a series of ‘somethings’ themselves; and those somethings seem to be working out rather well.

You can access and read the paper in full via this link Australian Exposure to China.

Happy Sunday.