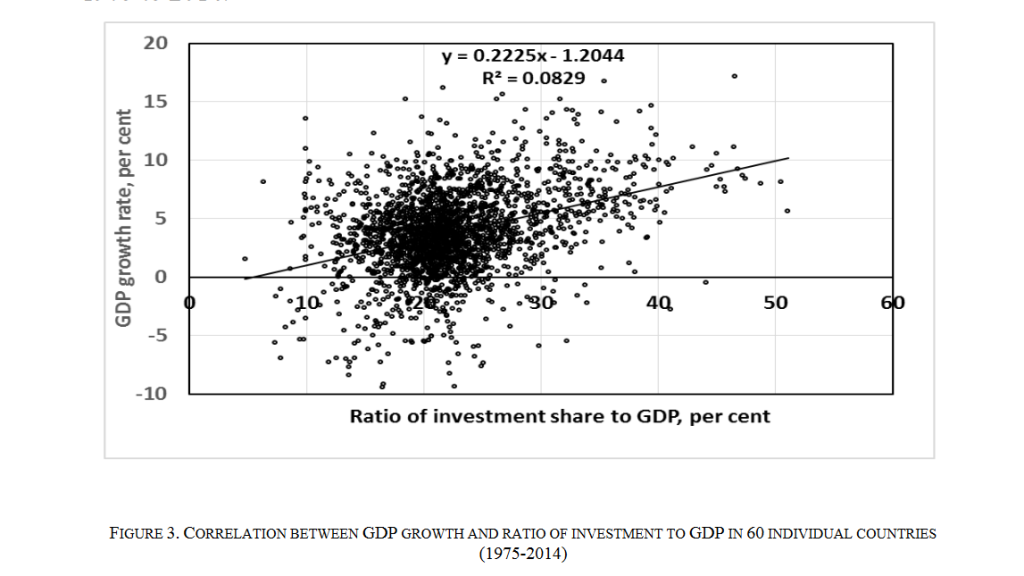

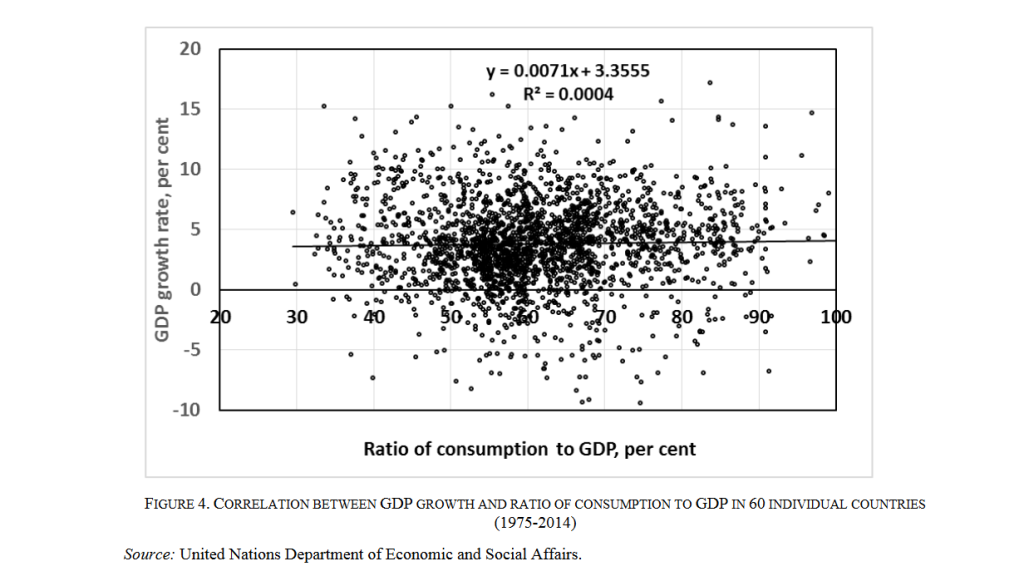

Sometimes just a picture (or two in this case) can sum up an argument.

Here you see the relationship between investment and growth for 60-major economies, 30-developing and 30-developed from 1975 to 2014.

Next, the relationship between consumption, as a percentage of GDP, and growth.

No Holmesian deduction required to see there’s a relationship in the first chart and none in the second.

Why is this so important? As the authors of the paper highlighted this week, Pingfan Hong and Hung Yi Li both writing for the United Nations Department of Economic and Social Affairs, point out the reality of these relationships is at odds with what most are now prescribing for China i.e. to shift from investment to consumption to keep the growth-pot bubbling.

In their own words, “..the correlation between the ratio of consumption to GDP and GDP growth is literally zero.” and “..no studies have shown that consumption is among the key factors for determining long-run growth..”.

The paper notes the common observation that the U.S. has a consumption/GDP ratio of 70% whereas China’s ratio is only 40%; so China must move to the U.S. level to become prosperous? This is to compare apples with tortoises. Per capita consumption in China has risen 700% in the 25-years from 1990 to 2015 but over the same period the U.S. level has only risen by 155%. So who’s really, relatively, better off?

The paper concludes “Raising consumption is the purpose, as well as the outcome, of economic growth, but consumption cannot substitute investment for driving GDP growth.There is no “consumption-driven growth” model.” [My bold and italics]

So what should China do to maintain economic momentum? “..the focus should be on how to improve social inclusiveness, economic efficiency and environmental sustainability,..”. At the same time though a lot more concrete will need pouring.

This has been my view for some time. What holds good for individuals holds good for society. You cannot spend your way to prosperity. Economic well-being is based on prudent investment and disciplined saving. Consumption is a byproduct of economic progress; not it’s motor.

You can access the paper in full via this link Avoiding Pitfalls

Happy Sunday.