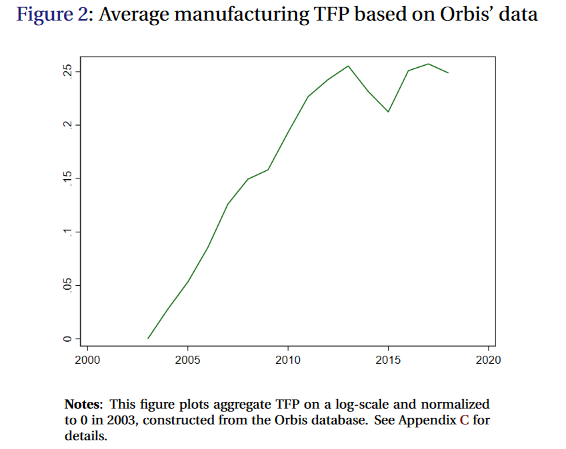

In an IMF Working Paper from February this year staffers Diego A. Cerdeiro and Ciane Ruane took a closer look at China’s flagging business dynamism. That this has occurred is in no doubt as the chart of Total Factor Productivity (TFP) from their study period, 2003~2018, shows.

Here’s a summary of their detailed findings:

- The revenue share of young firms has declined

- The life-cycle growth of young firms relative to older incumbents has slowed

- Weaker life-cycle growth can be explained by slower productivity growth and weaker investment in intangibles

- Younger and smaller firms are more capital constrained than their older and larger counterparts

- The responsiveness of capital growth to the marginal product of capital has declined, and,

- Large productivity gaps between SOEs and private firms persist

The researchers note China isn’t alone in this process and some of these trends have been observed over the same period elsewhere, including the U.S. [This link goes to the U.S. Bureau of Labor Statistics with more]

In China’s case though there’s an 800lb-panda-in-the-room and squaring up to that could provide some easy (and significant) productivity wins.

Videlicet: “The findings underscore the need for China to undertake pro-market reforms to boost productivity growth. In particular, SOE reform could boost productivity growth both directly through resource reallocation and indirectly by stimulating business dynamism.”

Having spent most of the last two-years beating up the private sector (education, property, fintech, the gig-economy and etcetera) perhaps China’s regulating authorities could apply themselves now to some more economically productive oversight? Just saying.

You can read the paper in full by following this link China’s Declining Business Dynamism.

Happy Sunday.