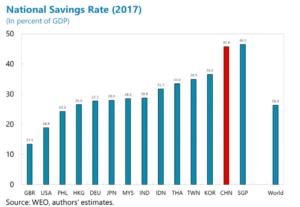

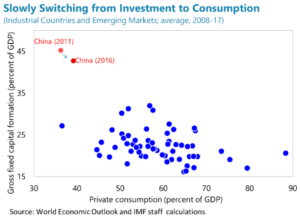

Two charts from an IMF Working Paper published last December sum up the problem.

The first shows how high the rate remains

The second shows just how little progress has been made in recent years in trying to reduce this.

The second shows just how little progress has been made in recent years in trying to reduce this.

Personally I’ve never seen why individuals, or countries for that matter, should ever apologize for saving. To the observation by a society hostess who once said ‘You can never be too rich or thin’ I’d add you can never have too many savings; but if everybody thought like this economists will tell you the world be a less vital place.

Personally I’ve never seen why individuals, or countries for that matter, should ever apologize for saving. To the observation by a society hostess who once said ‘You can never be too rich or thin’ I’d add you can never have too many savings; but if everybody thought like this economists will tell you the world be a less vital place.

They are of course correct. Saving, like alcohol, in moderation is a good servant; but if pursued to excess both become poor masters. Over-saving in China’s case has led to unsustainable growth, internal and external imbalances, is at the root of credit booms, and has ended up crimping consumption.

On a per capita basis Chinese consume at around the same level as Nigerians. Were they to consume at the same rate as Brazilians, with whom they’re on a similar wealth plane, their consumption would double from current levels; and this would probably be a good thing and is to be encouraged.

The paper notes households are ground-zero for the problem. The government and corporate entities are in the mix but households are the biggest component of the equation and therefore the IMF propose the following fixes:

1) Make income tax more progressive and ‘family friendly’. China needs more babies to help pay for the growing army of wrinklys and the poor are over-taxed; sort it out.

2) Increase spending on healthcare, pensions and education. In much of the West these services are de-facto ‘free’. China should try and get to this position.

3) Increase general spending on public services. China’s infrastructure is legendary but ‘soft’ infrastructure now requires attention [Start with the legal infrastructure perhaps?].

4) Get SOEs to pony up more. The current policy is for SOEs to increase their dividend payouts to 30% by 2020 [Pathetic!]. They need to do better to provide cash sooner for some of the above.

5) Improve formal access to credit for the private sector. The current administration seem to have backpedaled on this but if you want the private sector to save less allow them easier credit.

6) Continue to liberalize the service sector. By so doing more households will gain access to greater earning opportunities; and more earnings should, in time, lead to less savings.

There’s really no alternative to these prescriptions. Attending to some of these long-neglected issues would seem like a good use of planner’s time now? Enough with the high speed rail, at least for a bit, already.

You can access the paper in full via the following link China’s High Savings

Happy Sunday.