That China listens to the IMF is a reassuring and observable fact. So, when the IMF produces a targeted analysis on China’s currently single most serious problem, growth or lack thereof, it’s worth a closer squint.

In the IMF Working Paper at this link China’s Path to Sustainable and Balanced Growth staffers Dirk Muir, Natalija Novta, and Anne Oeking “..present a reform scenario with structural reforms to lift productivity growth and rebalancing China’s growth towards more consumption, that would help China transition to “high-quality”—balanced, inclusive, and green—growth.”, and who doesn’t want all that?

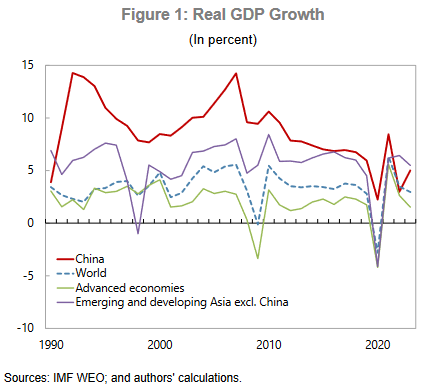

First, a reminder on how wrong its gone recently. China used to soar, now it shuffles.

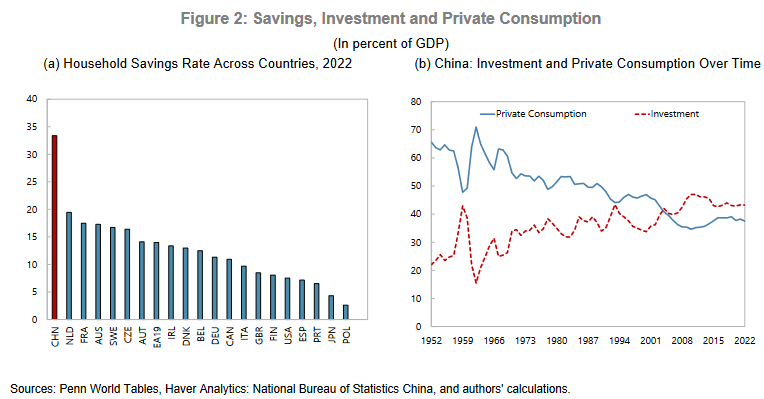

Here’s the elephant in the room. China’s citizens save ‘too much’ and consume too little whilst, at the same time, its government has a hit a diminishing-return wall for investment-led growth.

Given the sensitivity of the work the paper tiptoes around the fix; but these prescriptions have been publicly aired by the IMF before so aren’t a surprise. Their collections into a focused monograph though perhaps is.

There are five main areas the IMF think China should/could tune up:

- The SOEs. D’uh! A productivity gap between SOEs and the private sector of 6% has been estimated by other researchers. The benefits of just narrowing, let alone closing, that would be enormous.

- Market dynamism. Make it easier for people to form new businesses and then, almost as important, make it easier to fail. Other work indicates at least a 1% productivity lift is available via this route.

- Demand side rebalancing. Improved social welfare schemes will reduce saving. This would redirect resources away from metal-bashing to industries with higher total factor productivity.

- Increase retirement ages. For men it’s now 60 and women 55. An increase in stages to 65 for both would mitigate the falling workforce problem to a significant extent.

- Improve education. Make it easier to obtain, improve the quality and thus boost human capital. My aside: lots of engineers is a good thing, but not if they’re unqualified for the developing economy’s necessity.

China’s stock markets have fallen back from the enthusiasm they evidenced a couple of months ago. The reason in part is a realization that tinkering with interest rates or making it easier to own more assets the citizenry are long-and-wrong (property) of doesn’t represent real reform.

Until we start to see some of the issues above being addressed by China’s planners I’m happy to keep powder dry and so, I suspect, are those high-saving Chinese households whose precautionary savings represent a fear-gauge authorities would do well to pay closer attention to.

Happy Sunday.