If you have an interest in cryptocurrencies the work highlighted today from Robin Hui Huang and Sunny Xiyuan Li in a Research Paper for the Chinese University of Hong Kong Faculty of Law will be of interest.

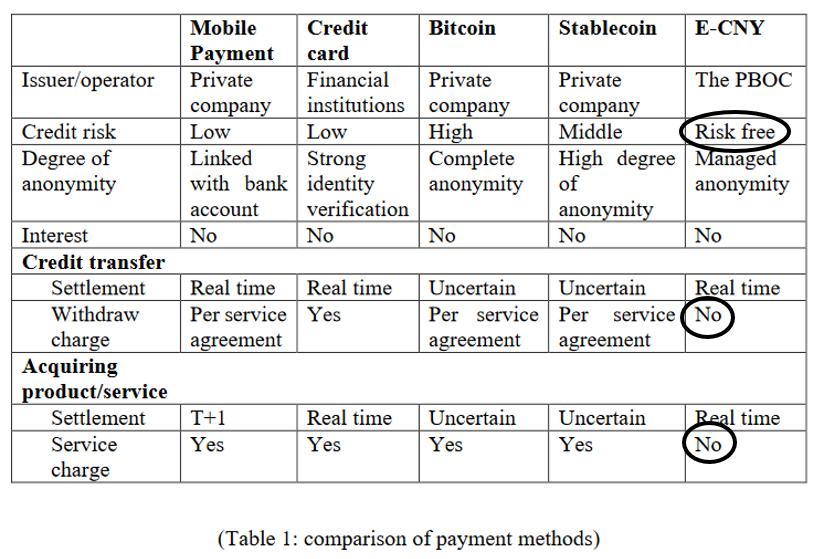

If you care about the development of China’s financial system, its central bank digital currency (CBDC, hereafter e-CNY) and why credit cards in China are redundant you should also review the full text.

If you just want a quick skim, here we go:

The e-CNY will do well as it’s a better mousetrap.

Compared to others’ plans, those of China for their e-CNY have five unique features that conspire to make it such an attractive proposition.

They are:

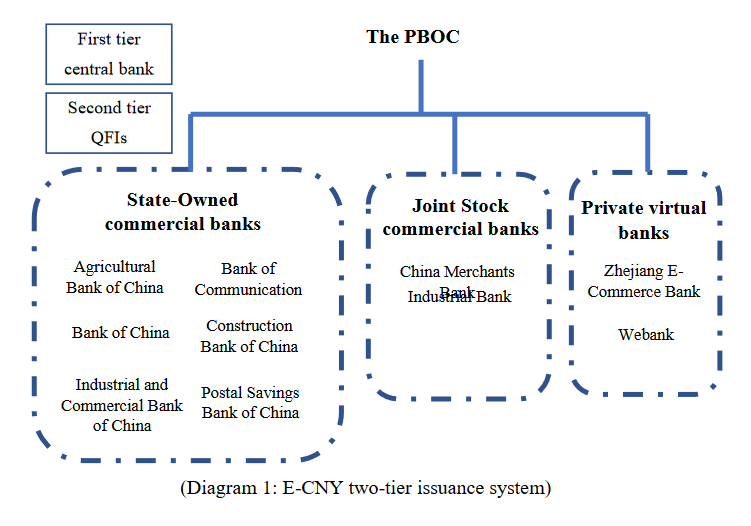

a) It has a ‘two-tier issuance structure’. Certain Qualified Financial Institutions (QFIs) are required to do the heavy lifting of providing the operating infrastructure. This avoids a direct relationship for users with the Central Bank and makes it a product from trusted and familiar counterparties from the get go.

b) There are three types of digital wallet. One offers a direct link to a bank account (for larger payments), another offers a partial link and a third will be untethered (for smaller amounts). This means the e-CNY is available, practically, to all who wish to adopt it.

c) It won’t pay interest. Not great for the users but they can link to interest paying funds if they like. For the infrastructure providers this means there won’t be direct competition with existing liabilities.

d) It doesn’t and most likely won’t use Distributive Ledger Technology (DLT). Existing DLTs have shown themselves vulnerable and are notoriously slow. [N.B. A final account management technology has yet to be finalized]

e) It’ll work offline. The fully untethered wallet will allow for near-field communication systems to swap e-CNY which addresses problems of the un-banked and those in rural communities who lack access to the formal financial system.

The paper concludes the e-CNY will succeed domestically because:

- It has full governmental support

- There’s no reason for markets and/or operators to retard its progress

- It has clear advantages over most existing settlement mechanisms

However, it’ll struggle for international acceptance as:

- Non-China governments may not be keen on cooperation

- Political trust. There’s a very basic issue with China

- Economic value of the CNY. Many may be wary of value over time

The paper notes much of the activity by other foreign governments in regards to their own CBDCs is perhaps be due to the ‘catfish effect‘ China is causing. FOMO, for many, is an important driving force but the researchers aren’t sure if there’s a first or last mover advantage.

You can access the full version of the paper via this link China’s CBDC, Prospects and Etcetera.

Happy Sunday.