Gary Clyde Hufbauer and Megan Hogan, both of the Peterson Institute for International Economics (a Washington based think tank), take a closer look at “The CHIPS and Science Act, signed by President Joseph R. Biden Jr. on August 9, 2022, [Which, in their words] represents the biggest US foray into industrial policy in 50 years.”

In brief, they find as follows:

- The legislation will increase U.S. chip production and stimulate research based in the U.S.

- China’s position as the dominant producer of lower end chips will not change and short-term chip shortages will not be relieved.

- Jobs will be created and in specific regions they’ll be material. They will not though add much to the overall U.S. total.

- The U.S. should not pursue substitution but concentrate on comparative advantage and continue to import low-end products.

- Specific measures in the act, the so-called “guardrails”, will retard Chinese and Russian higher end ambitions.

- Arrangements with friendly (to the U.S.) countries should ensure free trade in chips and shine a spotlight on subsidies where present.

- Subsidies to U.S. companies represent 8% of estimated future capex; below anticipated Korean, Taiwanese and Chinese industry assistance.

- Subsidies to U.S. companies will provide much higher incentives to build plant (c.85%) than progress R+D (c.15%). Why? Jobs.

- A ‘subsidy-race’ may have been triggered. Europe has announced a Euro-43bn package. Asian players have yet to directly respond.

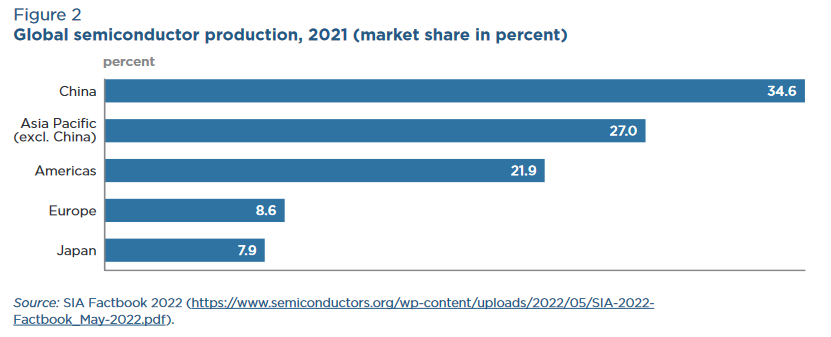

- American companies dominate technology in the chip ecosystem but the figure below shows why politicians are focused on production.

The paper concludes the steps taken by the U.S. government will be, on balance, effective. However, it closes with the following observation:

“While collective measures have inflicted considerable short-term pain on China, causing a sharp drop in the fortunes of its high-tech firms, China will respond by redoubling its self-sufficiency programs. Within three to five years, Chinese chip firms will likely approach, or even meet, the proficiency of US firms, TSMC, and Samsung.” [My bold and italics]

This all seem clear and looks, to me at least, like healthy-competition; which can only be of a profound net benefit to global consumers, no?

How investors in the sector are likely to fare from here though seems altogether less clear.

You can review the report in full via this link The future of Chip production.

Happy Sunday.