Felix Chang of the University of Cincinnati College of Law; Ohio State University (OSU) – Michael E. Moritz College of Law wants discussion on the greater international use of the Rmb to stop conflating CHIPS, SWIFT and CIPS. They are very different things and, to remind:

CHIPS or the Clearing House Interbank Payments System is where most large denomination U$ forex trades get settled. It dominates the global landscape for trades presently.

SWIFT or the Society for Worldwide Interbank Financial Telecommunications is the communication protocol that effects those transactions and is also the global standard.

CIPS, on the other hand, or the Cross-Border Interbank Payment System is the Chinese home grown system promulgated in 2015 for the settlement and clearance of Renminbi transactions with other market infrastructures. It’s tiny compared to the other two systems, is a complimentary service and, in its present form, cannot act as a substitute.

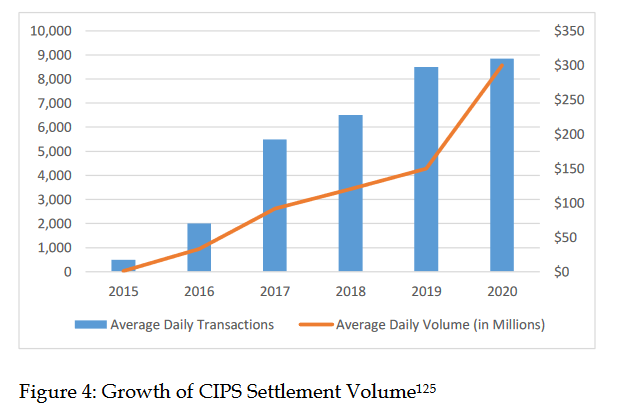

There’s no doubt CIPS usage has been growing; but this is to ignore the fact that the basis for comparison is zero and trades there presently account for a minuscule fraction i.e. less than 3%, of the global daily forex transaction total.

Moreover, the Rmb currently accounts for only around 2% of global forex reserves according to the paper and CIPS members are almost exclusively Chinese (and therefore de facto state actors). The bigger problem with this small group is there’s no possibility of network-effects taking hold in such a small pond of users.

The paper, at over 70-pages, goes into a lot more detail on how the various systems differ, what they do and don’t do and how CIPS, as long as it stays a Chinese government cat’s-paw, won’t rise to global prominence any time soon. In short, the CIPS system alone won’t promote wider Rmb usage.

The biggest reason of all though why the Rmb isn’t destined to become the world’s favorite currency is, as the researcher puts it: “..the Chinese state itself is not ready to deliver the political or fiscal stability that currency internationalization requires.”

The paper concludes China is well aware of some of the consequences of having a more liked currency but isn’t ready yet, or willing, to flirt with overvaluation or the loss of policy control implicit in such a move.

‘Rmb Global Domination!’ or some variation of this will persist as a click-baity headline* most likely, but for now these stories can be dismissed as the ‘Yellow-Peril’-phantasms of sloppy hacks they, in fact, are.

[*Ahem! A most recent example: April 13th, 2023 Fox Business News “Could the US dollar lose its reserve currency status to China?” Story here.]

You can access the paper in full via this link Renminbi Domination

Happy Sunday.