Zhenguo (Len) Lin (et al.) at the Florida International University (F.I.U.) Hollo School of Real Estate noticed studies on the relationship between a population’s age profile and housing demand were not only ambiguous but mostly related to developed economies.

Moreover, these studies had taken place in the contexts of a more genteel ageing pattern than China, which is ageing very rapidly by comparison.

Whilst several studies had come to the intuitive conclusion that an ageing society will be one in which housing demand decreases, many had not. A major flaw in the wrinklies-equal-less-housing-demand argument is it ignores many other variables and often assumes housing supply is inelastic. Over the longer term, it isn’t.

What the researchers discovered with a look at China were two major points that should be of interest to ALL China investors and especially those vexing about whether or not the real estate sector is investable now (it is BTW), or ever will be again.

Point #1. There IS a negative relationship in Chine between ageing and housing demand; BUT it’s offset in China’s case by the benefits of having a more highly educated middle-life cohort coming up. This still emergent group have more money, a higher demand for quality housing and are more urbanized than the presently old.

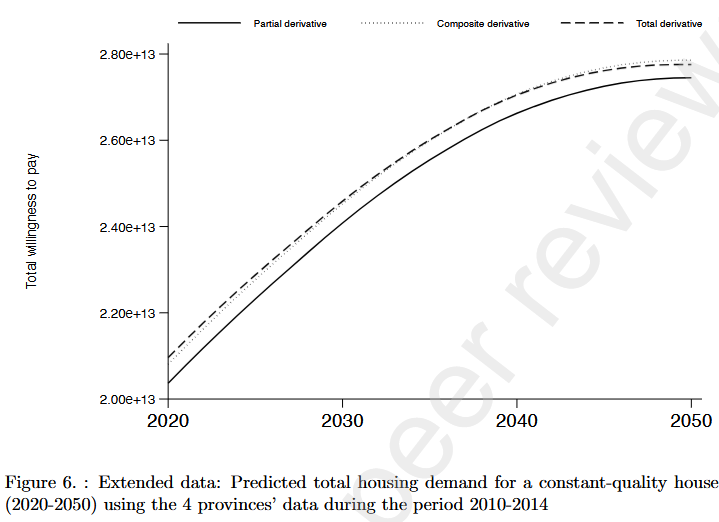

Point #2. The research steers clear of the issue of the likely progress of home prices but describes a rising arc of demand until 2045 based on the above.

There are some obvious caveats, but the middle-life educated up-and-comers-effect makes as much intuitive sense as the oldies = lower demand argument and in China for as long as the first effect remains dominant investors in the sector have little to worry about. At least as far as the demand side of the equation is concerned.

There remains plenty of other stuff to be cautious about in the meantime of course!

You can access the paper in full via the following link Demographics and Housing Demand.

Happy Sunday.