There’s a view among some fund managers that corporate site visits are unnecessary. A good company, the argument runs, should be providing via it’s regular reporting sufficient information on its operations to allow investors to make informed decisions about their prospects.

Perhaps this is the case in developed markets where a mature culture of corporate stewardship and communication is the norm; but, as the paper highlighted this week shows, this is not the case in China and, by implication, other young stock markets.

Qiang Cheng, from the Singapore Management University (et al) looked at a sample of 21,189 site visits to 1,040 firms in 2,859 firm years from 2009~2013 involving firms listed on the Shenzhen Stock Exchange.

This is the first study that’s been done using such granular data and the results therefore are highly significant. [The study was made possible by a requirement from 2009 Shenzhen listed companies must detail in their annual reporting all site visits, by whom, and their specific nature.]

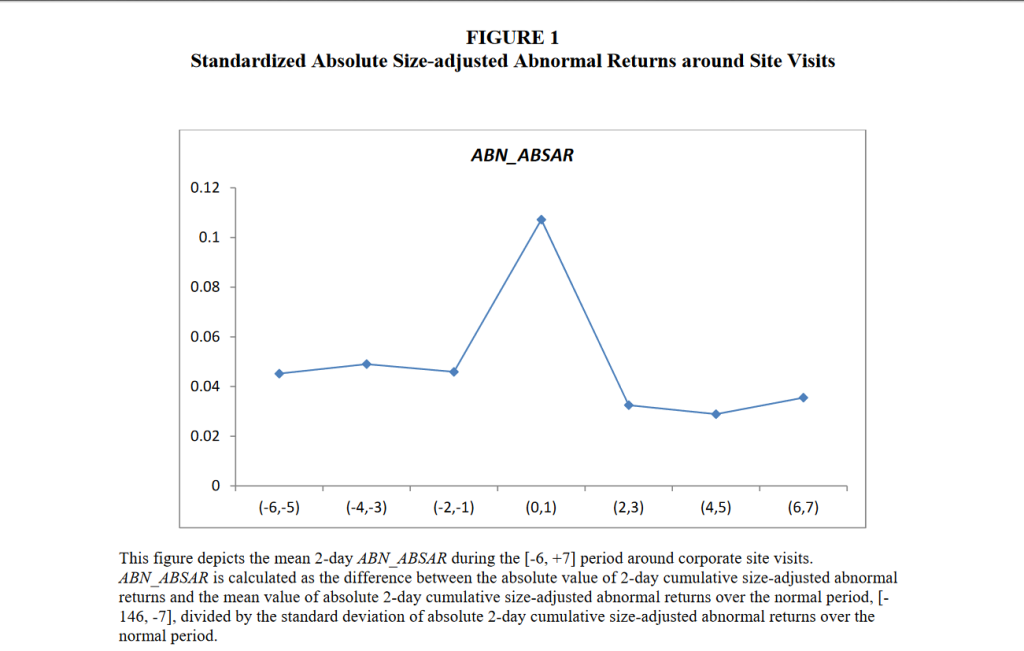

The research concludes “..site visits are important venues for investors to collect information about firms and make informed trades.” How important? The chart below shows the abnormal stock price movement that occurs in the two-day window around such events.

There’s a near 10% relative move in the stock price and as the researchers go on to highlight this is not just ‘noise’; it’s usually the harbinger of better earnings ahead.

Not all firms are visited equally. They find “..the likelihood of site visits is higher for manufacturing firms, firms with a higher market share, larger firms, firms with higher analyst coverage, profitable firms, firms with more business segments, older firms, and firms with higher book-to-market ratios.” One of the key findings is these visits are especially useful because “..top executives such as CEOs and CFOs are usually not involved.” [My bold and italics]

In addition they find visits involving groups of investors/analysts have more impact, because more information gets squeezed out at the plural discussions that ensue. Moreover, visits by or with a high concentration of fund managers produce more marked effects as these people pull trading triggers shortly afterwards as an analysis of changes in their holdings shows.

You can access the paper in full via the following link Do Corporate Site Visits Impact Stock Prices?

Personally, I’ve never been in any doubt. Besides, in addition to visits being an indispensable analytical tool, they’re usually quite fun.

Happy Sunday.