That the U.S. is the center of the global financial system is so incontrovertibly obvious you’d think there was little mileage in fact-checking the observation?

For over 40-years, according to the researchers of the paper highlighted this week, the U.S. has transmitted good news from its markets to others around the world and shocks to returns there have presaged similar moves elsewhere. The last and best example of this was the Global Financial Crisis.

The counterfactual is to note, over the same period, problems in non-U.S. markets have not been transmitted either to the U.S. or globally. Since 2018 this one-way flow of cause and effect has changed though and, you guessed it, China has become a major influence.

The change began in the run up to the first imposition of Trump-tariffs in February 2018 and the effect continued and intensified into the COVID-19 outbreak and the run up to the WHO deceleration on March 11th 2020 of a global pandemic.

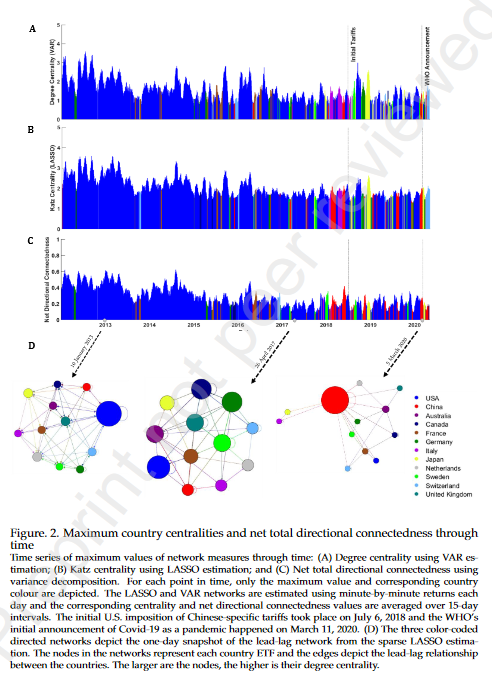

The chart from the work (concentrate on the blobs at the bottom) here expresses this neatly.

The researchers point out “..the centrality of China is a very recent phenomenon, and may be transient.” but we real-world practitioners know, it probably isn’t.

They end their piece with a hope that this newly bipolar world will encourage the two economic superpowers to greater scientific collaboration and cultural exchange and we real-world practitioners share the same sentiments but know the reality of collaborative progress is likely to be somewhat, er, less than eager?

You can access the work in full via the following link The U.S. Gives Way To China, A Bit.

Happy Sunday.

[One observation from me. The research uses the minute by minute interrelationship of 12-country-specific ETFs quoted in the U.S. from 2012 to 2020 to form conclusions. The ETF for China being used is the iShares MSCI China ETF (MCHI) which over that time became very heavily influenced by just two stocks Alibaba and Tencent. This may not undermine the conclusions of the work but some caution should be applied when reporting the summary to others, as I hope I’m doing here.]