Let me start with my position on Chinese banking NPLs. I believe numbers produced by Chinese banks are too low. The true situation is larger than the numbers suggest; but this is widely understood.

Are the numbers as high as some breathless analysis in recent years have suggested (Fitch 20%)? No. Can the problem be contained and are authorities fully aware of it. Yes. Do problems represent a dagger pointed at the heart of the financial system and are Chinese bank’s valuations failing to take account. No and again no.

In short, Chinese banks are fundamentally stable, are not going bust and will continue to pay solid dividends for years to come. As a result, they are far from un-investible.

Now to the paper highlighted this week. Robert L. Mayo from the George Massey University has taken a novel approach to assessing the accuracy of Chinese banks’ reported data.

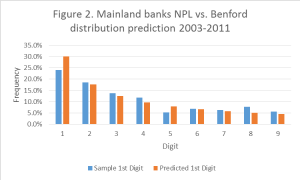

Using a technique well established for detecting accounting fraud he applies ‘Benford’s Law’ to certain aggregates. Benford’s Law predicts how frequently numbers will appear in the leading digit of data that’s the result of other computation and believe it or not the number 1 should come up around 30% of the time (there’s more on the why of this in the paper).

Therefore if you have a data set (this only works for certain types of data sets but its very appropriate here) with too few 1s its probably fudged. So, what did Mr. Mayo find when he looked at data from Chinese banks on NPLs?

In a word; gotcha! There aren’t enough 1s.

To crosscheck the work the same analysis was run on data from banks in Hong Kong and there the right amount of 1s came out.

In addition to NPLs the research also looked at customer deposits, operating expenses, net income interest, non-interest income and total assets. With only the exception of total assets all the other aggregates passed muster.

I used the word ‘fudged’ above but the paper calls the findings ‘..deliberate fraud.’ [Harsh, Ed.]. However you describe the phenomenon the paper fairly points out when Chinese banks were small, not so long ago, this would have been a mere curiosity; but these days, given their heft, the continuation of this practice borders on reckless*.

The paper in full is a well written and easy read and can be accessed via the following link Hidden Risk.

Happy Sunday.

[*The study period is 2003~2011. It’s possible the situation has improved in recent years as banks were under particular pressure to window dress during and just after the GFC, as the paper also highlights; but do we think the practice no longer occurs? I’m taking the fifth.