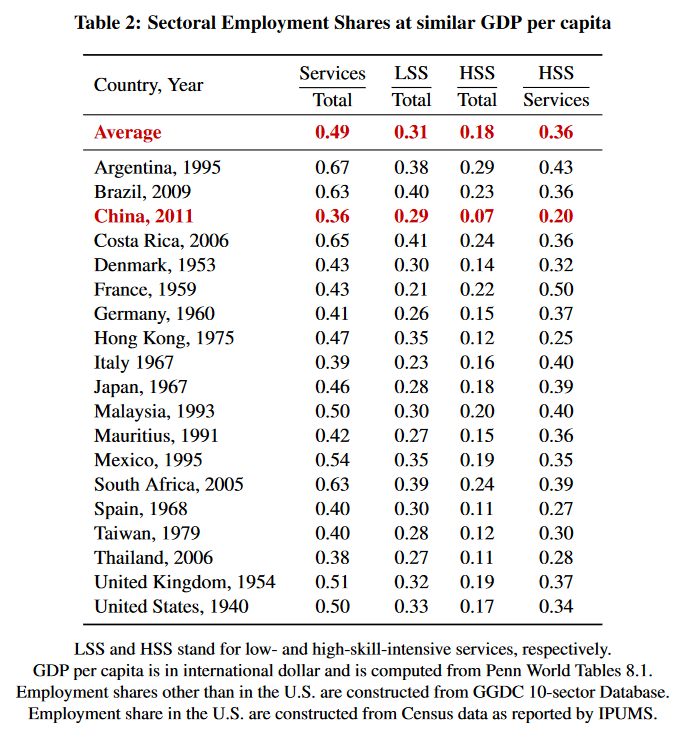

[How to read this table (below).] What you see here are major economies when their respective PPP per capita GDPs were the same as China’s is today. So, for example, U.S. data is taken from 1940, the United Kingdom from 1954, Argentina from 1995 and so on.

The question the researchers who wrote the Working Paper for The Federal Reserve Bank of Atlanta highlighted today are looking to answer is this: Why is China’s present state of employment in high-skill-intensive services so retarded?; because, according to the table, it clearly is.

Lei Fang and Berthold Heurendorf, the paper’s authors from the Federal Reserve of Atlanta and the Arizona State University respectively get into some seriously wonk-tastic math to ferret out their working hypothesis which is both intuitive and worrying [Skip to P.20 section 5.2 for the full argument] .

China’s problem, in a nutshell, is that the jobs that should be the propellant for China’s continuing ascent into broader economic development are, in the majority, the gift presently of SOEs. For example both healthcare and finance, apart from some headline grabbing progress in the larger cities, are industries that remain within the orbit of China’s biggest SOEs.

The paper stops short of trying to get a bead on how much this distortion may be holding China back but concludes ” We have found that large distortions [Created by SOE involvement] limit the size of high-skill-intensive services in China. If they were removed, both high-skill-intensive services and GDP per capita would increase considerably.”

Indeed, they most likely would; but who’s going to lead the charge for this reform? It’s worrying that no names presently spring obviously to mind.

You can access the paper in full via the following link High-Skilled Services in China.

Happy Sunday.