The study highlighted this week, a 275-city analysis from 1999 to 2016, claims to be the most comprehensive analysis to date of China’s urban property market.

Researchers Keyang Li, Yu Qin, and Jing Wu from the Tsinghua, Singapore and again Tsinghua universities respectively wanted to not only settle the much discussed affordability issue but also see what the second order effects of too-high home prices might be?

First the good news. In the study it was found prices in 90% of the cites surveyed remained affordable relative to incomes over the observation period. These cities account for around 75% of China’s urban population so that’s a big Phew! and a long-term good-to-know.

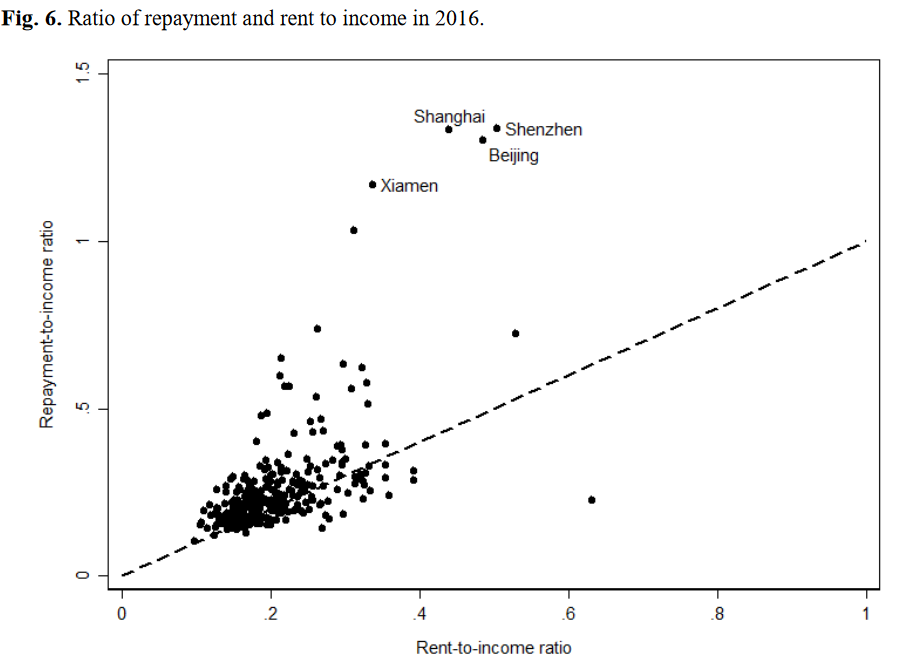

Now the bad news. Four ‘superstar’ cities emerged from the data and here the picture is less rosy. In these superstar cities home prices have outstripped income growth and some hard to fix associated problems have been created. Videlicet? High prices have jacked up levels in the hinterland and the net effect of this is longer commuting times for workers and smaller living spaces. Neither of these conditions being associated, anywhere in the world, with an improved quality of life.

The problem cities are clear from a number of analytical angles (charts at the back of the paper) but here’s just one that shows the outliers especially clearly.

The authors note problems in these cities have gotten worse since 2010 when the government stepped in to slow the housing market down. An unintended consequence of price suppression policies has been a shortage of new land for development and a therefore an unhelpful shortage of new housing stock.

The authors note problems in these cities have gotten worse since 2010 when the government stepped in to slow the housing market down. An unintended consequence of price suppression policies has been a shortage of new land for development and a therefore an unhelpful shortage of new housing stock.

My own concluding two-pennyworth would be to remind speculators in the superstar cities of Beijing, Shanghai, Shenzhen and Xi’an to take care. When problems like this crop up in China authorities are rarely far behind with a solution.

You can access the paper in full via this link China – Housing Affordability.

Happy Sunday.