In the latest Asia and Pacific Regional Economic Outlook the IMF have devoted around a third of the publication to a review of China.

The reason, I think, is twofold:

First, as they point out, the region will contribute two thirds of global growth in 2024 with China accounting for the lion’s share. Prospects for the world’s second-largest economy are therefore of interest to all.

Second, and this is purely my speculation, I believe they’re sending a message to China’s planners (with whom they’ve had a constructive dialogue in the past) about the risks of allowing an output gap to become institutionalized.

They note China’s 2023 recovery has ‘lost steam’. Manufacturing purchasing managers indices have registered negative growth from April to August, property market problems have been protracted and investment has weakened reflecting both external demand and a downturn in the technology cycle. Low inflation may be a virtue but it’s also indicative of what they describe as “..sizeable economic slack.”

To reflect the above their growth forecasts for 2023 and 2024 have been cut by 0.2% and 0.3% to 5% and 4.2% respectively. At the same time, they highlight (surely, not coincidentally) forecasts for the U.S. were most recently revised sharply higher.

In the China section (from P.24) they run through two scenarios; one where domestic reforms are progressed and one where global de-risking incorporates not just more friend-shoring but near and onshoring together with an increase in non-tariff trade barriers.

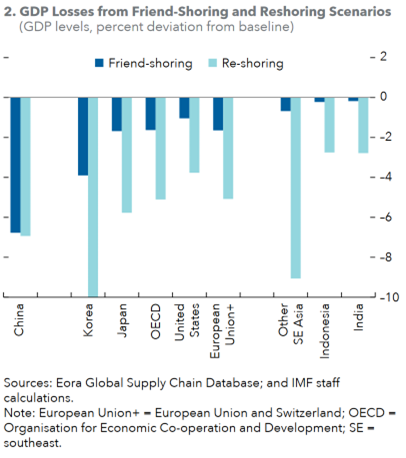

The negative scenarios, for China and the rest of the world, are summarized in the table below.

What’s striking is in both cases, either just friend-shoring or the full re-shoring scenario there are NO winners. The report concludes that if these trends were progressed back to, say, levels that existed in the year 2000 the effect would “..translate[s] into global GDP losses of 4.5 percent and 1.8 percent, respectively.” [For the friend and re-shoring scenarios separately]

What I think the IMF are saying, in summary, to China is this:

- The world will be a less friendly place, in terms of trade, for you in future than its been in the last 20-years.

- This is partly due to the growing importance of service industries versus manufacturing where the latter has been your strength.

- It’s also due to hostility, which won’t change, driving friend/near/on-shoring trends. No matter how these trends progress their effects are unequivocally negative for you.

- You can’t change the world but you can do A LOT more domestically to tune up your economy (and you know what we’re talking about).

- You have a choice; deepen and speed up domestic reform and continue to progress. Or, fail to do this and self-retard not only your own progress but that of your Asian neighbors and the rest of the world.

Let’s hope the message gets through. There are not-good consequences for all of us if it fails to.

You can review the report in full via the following link IMF Asia and Pacific Outlook October 2023.

Happy Sunday.