How to cure trade imbalances? The paper highlighted today is from January this year and penned by Bank of England staffers Mark Joy, Noëmie Lisack, Simon Lloyd, Dennis Reinhardt, Rana Sajedi and Simon Whitaker. It makes an important contribution to the question.

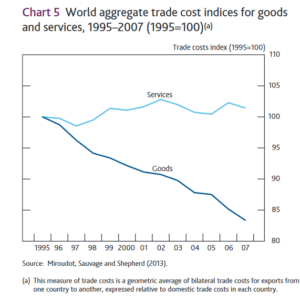

They note that trade imbalances have only been a hot topic in recent years. A period, since 1995 when trade liberalization took off, characterized by significant improvement in the global trading system.

Countries such as Germany, China and Japan that were already good at making stuff have prospered and their current account surpluses reflect this. Countries like the U.S. and the U.K that are good at providing services haven’t done so well as there’s been no parallel drive to liberalize provision of services.

Moreover, winners in the trade game seem to have gone out of their way to stifle service growth on their home turfs.

The picture here is worth more than 1,000 words.

This explains the push back I get from (mostly well heeled) friends when I point out what a wonderful world we live in thanks to increased global trade. I point out that autos, TVs and all manner of doo-dahs have never been cheaper. They point out that’s all well and good but what about school fees, medical costs and the price of a good plumber? [There are service liberalizing cures for all of those problems BTW]

This explains the push back I get from (mostly well heeled) friends when I point out what a wonderful world we live in thanks to increased global trade. I point out that autos, TVs and all manner of doo-dahs have never been cheaper. They point out that’s all well and good but what about school fees, medical costs and the price of a good plumber? [There are service liberalizing cures for all of those problems BTW]

The paper’s authors suggest the next big thing for global trade organizations to busy themselves with should be liberalizing trade in services.

Why should Chinese savers be offered only the choice of bank deposits with artificially low interest rates, a stock market blighted with shabby practices or overpriced real estate for their spare pennies? Why does America make visiting the place so unpleasant for foreigners when it should be busting open its tourist industry?

There are cultural biases that explain some of the frictions. Japanese seniors in a recent study said they’d prefer robots to care for them in their older age rather than foreigners. Swabian housewives will be loathe to give up their energetic mattresses-stuffing habit but just as with trade before liberalization a lot of arguments for not addressing issues will be discovered rooted in self serving vested interest.

Few but the very flattest of earthers though could disagree with the authors conclusion; “..liberalising services trade, levelling up to the liberalisation seen in goods trade, could reduce excess global imbalances…. Moreover it could contribute to higher and more inclusive global growth.”

And who wouldn’t want that?

The paper is a refreshingly un-wonky 18-pages with some other useful charts and you can access it in full at the following link Mind The Gap.

Happy Sunday.