The IMF were in Hong Kong recently and a summary of their conclusions and recommendations was released last Wednesday, December 4th. You can read that in full here HKSAR IMF Health Check December 2019; but if you don’t have time here’s a very brief summary. Spend! Spend!! Spend!!!

The team note a recent fiscal stimulus but belief this package will need following up with a bigger one, soon, and the authorities should be ready to re-load the money-cannon if the economy slips into a worse condition than they’re predicting.

How bad is the HKSAR economy right now? It’s predicted to contract 1.2% this year [2019], which doesn’t sound so bad until you read on. It’ll recover by 1% next year. Minus 1.2% followed by plus 1%, put another way, is a TWO YEAR CONTRACTION; and that’s sort of a best-case scenario. Interestingly the report’s section on further downside risks runs to 15-lines while the upside scenario is a (pretty lame and very reach-y) 4-lines by comparison.

The Report recommends countermeasures specifically as follows:

- Increase fiscal stimulus – bring forward any/all planned infrastructure spending

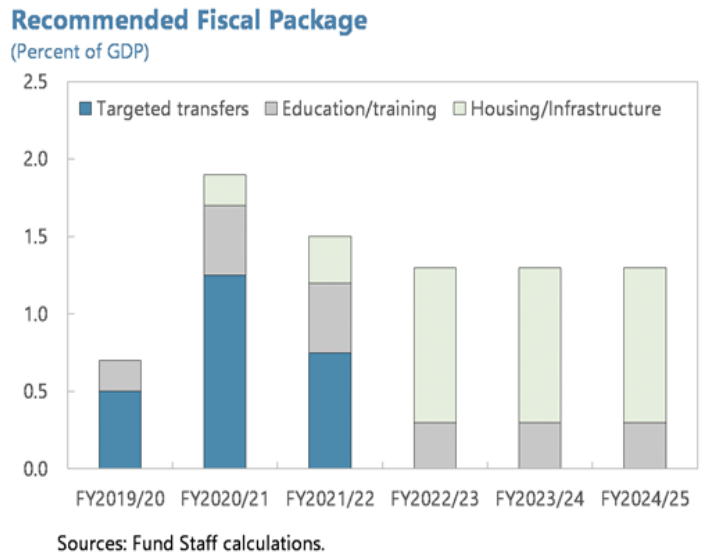

- Consider a medium-term fiscal package – to include targeted transfers to vulnerable households and SMEs. Build more homes

- Increase education and training budgets (see the chart above)

- Have a plan to reload the money-cannon if and/or when conditions deteriorate further

- Ensure fiscal stability – raise revenues via a VAT [No freakin’ way! Ed.], raise excise duties, increase top rates of tax and consider carbon taxes

- Optimize spending – initiate regular ‘fundamental’ spending reviews, develop a long-term plan for healthcare spending

- Reduce reliance on property related revenue and encourage greater labor force participation via more child care services

- Contain housing market risks – increase supply and accelerate the increase, phase out discriminatory taxes and make sure mortgage lending doesn’t leak into shadow lenders

- Safeguard financial stability – develop green finance initiatives and further develop Greater Bay Area economic cooperation

- Keep the peg

You need to read between the lines a bit but the conclusion is pretty clear. Hong Kong is in trouble, reserves will have to be mobilized and taxes will have to go up.

This is probably not the outcome the heavers of Molotov-cocktails and their supporters (about 70% of the population it turns out) had in mind as the logical progression of their so enthusiastic up-stuffing of the domestic economy.

To the Hong Kong folk then who helped to make this bed, good job; may you enjoy the lying in of it for many years to come.

Happy Sunday.