The Solow Growth Model (Solow Model, a quick primer), named after Nobel prize winner Robert Solow explains how an economy can grow relative to inputs such as capital, technology and labor.

As Tianyong Zhou of the Dongbei University of Finance and Economics points out however this model does a poor job at explaining China’s past rates of economic growth. He then looks forward and notes, the Solow Model and work based on it would imply China’s potential for future economic growth is no better than a steady 2%~2.5%. Which is what many others have also concluded.

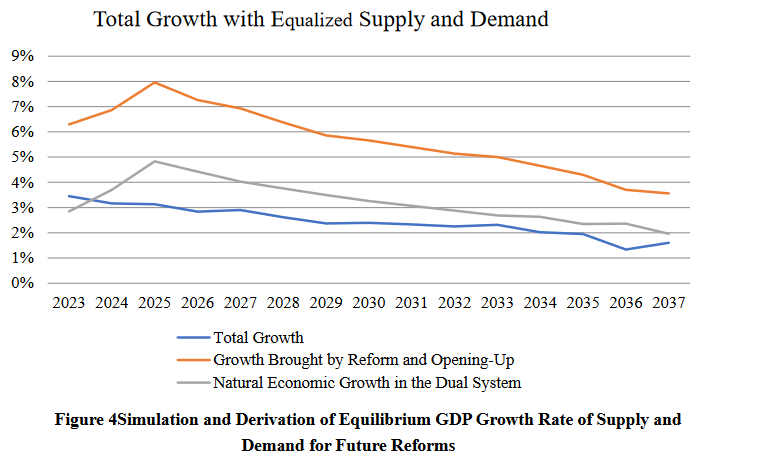

His work however implies a much higher potential, of around 5.5% from 2023~2027. Why the discrepancy?

The answer, in a nutshell, is that China’s economy contains a de facto hidden surplus in the form of deeply buried inefficiencies and unrealized assets which can be liberated by reform and better management; much as it was in the past generating those ‘abnormal’ past growth rates.

I don’t have the smarts to form a view on whether or not the models employed by the research team at Dongbei U. are credible, but the notion that China can progress at an accelerated rate via better resource management makes intuitive sense.

The picture above extracted from the paper shows how the future could look with, and without further reform. I have no doubt China’s planners are already acquainted with this picture, and in years ahead will be very focused on that orange-line-potential.

Whether or not the above proves to be an accurate forecast of future growth is less important than to highlight that China remains a ‘transitional’ economy and thus the analytical tools applied in more developed markets may not be appropriate for expressing future potential.

You can review the work in full via this link How China grows at 5.5%

Happy Sunday.