The paper highlighted today is the most important piece I’ve read in a long time on the subject of ‘value’. It’s dense and not easy to summarize but I’ll have a go, in bullet point form, below.

For practitioners the full-read is a fiduciary responsibility [You can access it via this link Reports of Value’s Death May Be Greatly Exaggerated.]

Laity need only be aware that the ideas in this work may affect the way stocks are priced for years to come, with many appreciating substantially with no change to either earnings-power nor underlying business prospects. Huh? Indeed!

Now, that summary:

- The ‘value’ versus ‘growth’ argument is very often (especially by growth partisans!) mis-specified as the growth-gauge used is the, pretty useless indicator, price to book (P/B).

- Everybody, and I do mean everybody, knows that P/B has been a flawed indicator since about 1930. If you adjust studies to include balance sheet intangibles, as ALL GOOD value managers do, the two styles haven’t performed so differently from 1963 to about 2007.

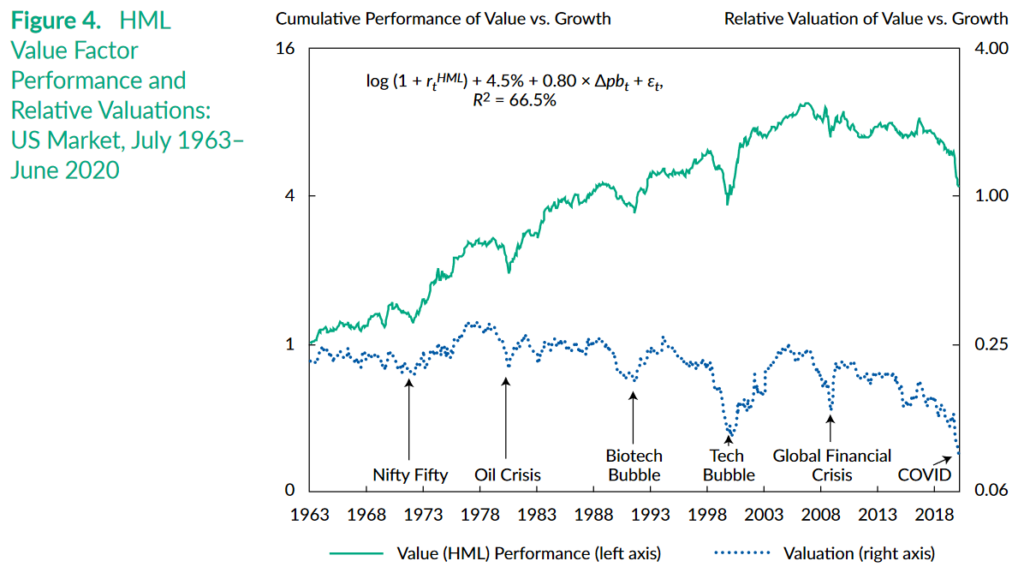

- From 2007 onward a long term erosion in the valuation of value stocks accelerated and reached a 57-year extreme in the middle of 2020.

- This relationship is already reversing and the authors of the paper believe “..value is highly likely to outperform growth in the years ahead.”

- The ‘low interest rates favour growth stocks’ argument has no basis in analysis of markets from 1926 to 2020.

- Value stocks have done a pretty good at delivering returns, even in recent years; BUT, it’s the lower valuations these stocks have been ground down to that explains nearly all their growth-vs.-value-under-performance.

- Even if ‘value’ stands still from it’s current depressed level the effect of dividends and some of these stocks growing their earnings forcing them to ‘migrate’ up and out of the group will provide superior returns to growth stocks.

- The important point is that it’s valuation that’s that been the problem for value stocks in the past and it’s therefore most likely that rising valuations will produce the very superior returns the research suggests are ahead. Particularly versus the much more highly valued complex of stocks that have been preferred by speculative/growth investors in the past.

- Even if nothing much changes from here you’ll do better now in value as the researchers point out “If, as history suggests, there is any tendency for mean reversion, the expected future returns for value, by almost any definition, should be above historical norms ..even if the relative valuation remains in the current bottom percentile ..[Value] should offer a positive overall return.”

- The chart below shows (the top green line) returns for value since 1963 to the middle of 2020. Not, in fact, that bad. The dotted blue line below shows the valuation relative of value versus growth stocks which hit a 57-year low in the middle of 2020.

The paper was written last year and was then speculative theory. Based on recent market moves it seems this thinking is becoming accepted wisdom.

Happy Sunday.