In seeking to contrast explanatory variables for stock price movements in the U.S. and China the authors of the paper highlighted this week turn up some extremely valuable perspectives on China stocks for investors.

Jianan Lu, Robert F. Strambaugh and Yu Yuan, all affiliated with the Wharton Business School, wanted to see if ground breaking work by Messieurs Fama and French in 1993 on U.S. stocks could be replicated in the China domestic stock markets?

Turns out, it can’t; but not because the approach is unsound. To understand China stock prices (mostly) fully the Fama and French value yardstick of book to market (BM) has to be dropped in favor of the value guide that works best in China, the ratio of earnings to price (EP). Moreover, when testing the effect of size on return this only works in China if the bottom 30% of stocks (about 7% of market cap so not a big loss) are excluded.

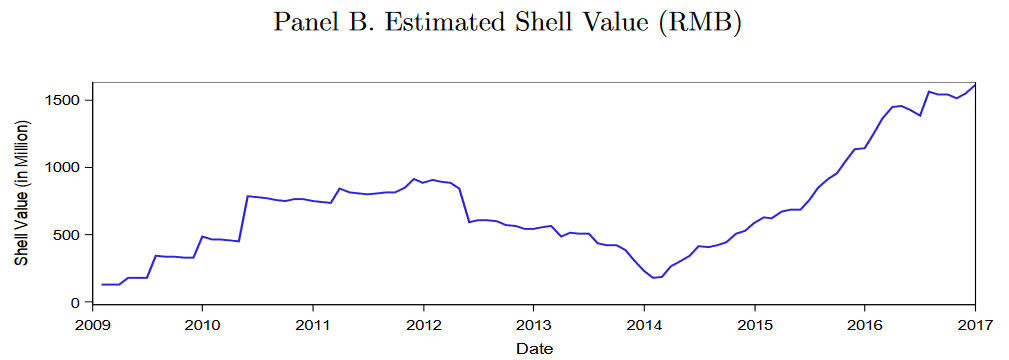

The authors avoid the weeds of why EP is a more reliable value gauge than BM in China (I’m happy to put forward some ideas privately though) but they do get into why the bottom 30% of the market may be incorrectly priced. The chart from the paper here is the answer in a nut-shell.

The formal IPO process in China is a long and expensive process. Firms will pay a hefty premium therefore to acquire a company that can be used as a vehicle for a reverse takeover. How much will they pay? The authors calculate the present premium to be around U$200m. This compares with just U$2m for a similar fit-for-purpose vehicle in the U.S.

The formal IPO process in China is a long and expensive process. Firms will pay a hefty premium therefore to acquire a company that can be used as a vehicle for a reverse takeover. How much will they pay? The authors calculate the present premium to be around U$200m. This compares with just U$2m for a similar fit-for-purpose vehicle in the U.S.

Perhaps as much as 30% of the value of the bottom-30% of companies in China may currently be attributable to ‘shell-premium’; and, as the chart shows, the premium has risen sharply in recent years.

There are two valuable messages for investors that come out of this work:

- Small cap stocks in China (the same applies to a certain extent in Hong Kong I’d add) are, in general, overvalued. Value investors are therefore especially cautioned about wasting time with tiddlers.

- The best guide to value mis-pricing when looking at domestically listed Chinese stocks is the ratio of earnings to price (less true in Hong Kong, in my opinion).

In summary, an easy to follow KISS*-principle will serve investors well in China. Videlicet? Look for big stocks with high earnings relative to their price; and well, er, that’s mostly it.

The paper in full can be accessed via the following link Size and Value in China

Happy Sunday.

[*KISS = Keep It Simple, Stupid!]