What’s wrong with the following statement?

The Chinese save too much; and this leads to a large current account surplus that’s destabilizing for both them and the world.

It may have been correct ten or even five years ago; but IT’S NOT NOW.

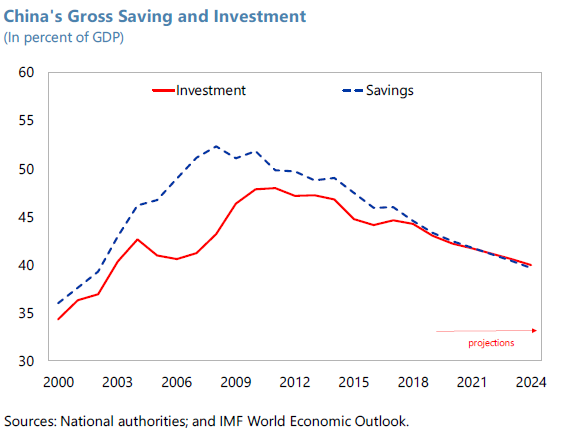

Let’s first have a look at that over-saving notion. The chart here has been extracted from the IMF Working Paper highlighted today.

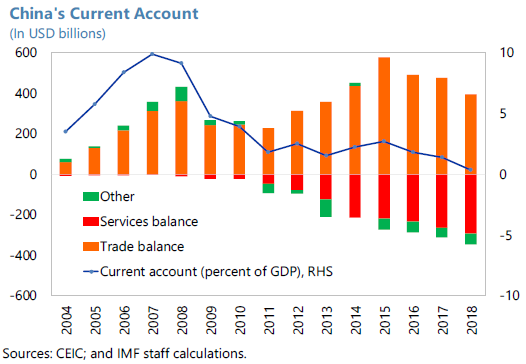

Now let’s have a look at that de-stabilizing current account surplus.

Surplus? What surplus?

So what’s going on here?

This isn’t just some happy fluke. The current account balance is declining for all the right reasons and the change isn’t a cyclical one-off (although a lot of the improvement in 2018 was). This change is the product of policies put in place some time ago to produce precisely the effect we now see.

Videlicet?

- Re-balancing. Since 2015 the Chinese economy has been more service than manufacturing driven. This trend will only intensify.

- A shift of the Real Effective Exchange Rate to more effectively reflect the rich-country reality of China Inc.

- Increasing outbound tourism. Don’t say you haven’t noticed this?!

- A moderation of the growth of China’s goods surplus with the rest of the world. This is also a trend likely to continue.

My two pennyworth. Here’s an example of how patient planning and the passage of time renders alarmist projections from the Pants-on-Fire! School of China critics [Utterly? Ed.] useless. The incorrect assumption of most Chinazallstuffeduprunaway analysis is it often rests on an ‘If things carry on as they are..’ argument. Here, in plain and reassuring sight, is a good example of how in China things rarely, if ever, carry on as they are.

You can read the paper in full by clicking through the following link China’s Shrinking Current Account Surplus.

Happy Sunday.