From the longer document here I’ve extracted the key messages from each article with a link so you can follow up on each if you’re sufficiently interested. Larry Summer’s piece (second highlight, below) is especially helpful.

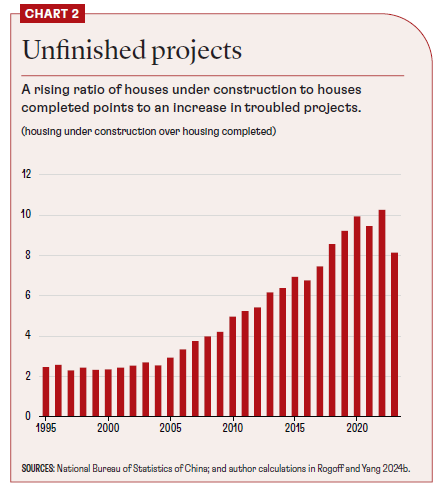

CHINA’S REAL ESTATE CHALLENGE. Kenneth Rogoff -Maurits C. Boas Professor of Economics at Harvard University. Yuanchen Yang, eonomist in the IMF’s Western Hemisphere Department. No easy fixes and no end in sight seems to be the grim conclusion of this piece.

“..it is now painfully clear that China is not as different as most scholars still thought just five years ago. Like many other countries in the past, it too is facing the difficult challenge of countering the profound growth and financial effects of a sustained real estate slowdown.”

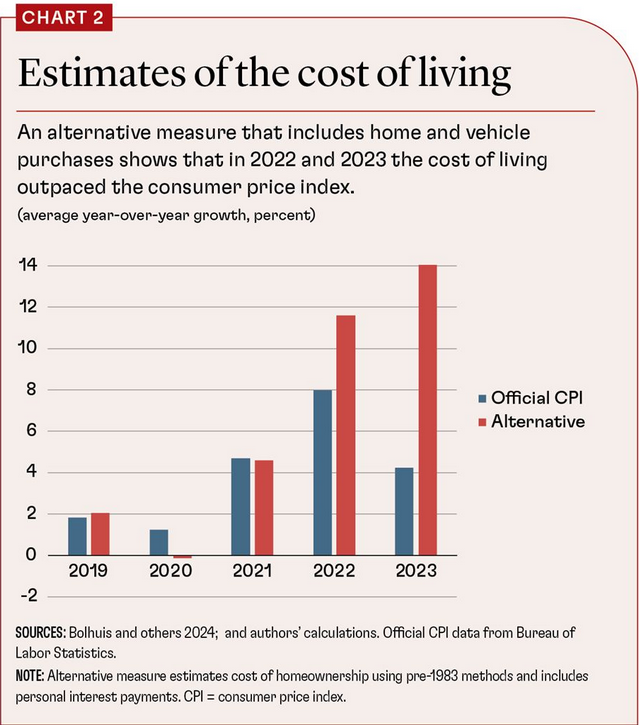

THE TRUE COST OF LIVING. Lawrence H. Summers (et al.) – Charles W. Eliot University Professor at Harvard University and a former US Treasury secretary. Why are Americans so grumpy? Here’s one answer:

“If the housing supply remains depressed and lower interest rates only inflate prices, consumers may wind up even more pessimistic than the misery index suggests.” More homes needed, others elsewhere concur. Viz.?

ARE HOUSING MARKETS BROKEN? Hites Ahir – Senior Research Officer IMF Research Department. “..just trying to help people buy homes—using demand-focused policies such as debt-to-income ratios, loan-to-value ratios, or changes to interest rates—will not work. The solution must come from supply-focused policies. Above all, we must build more homes.”

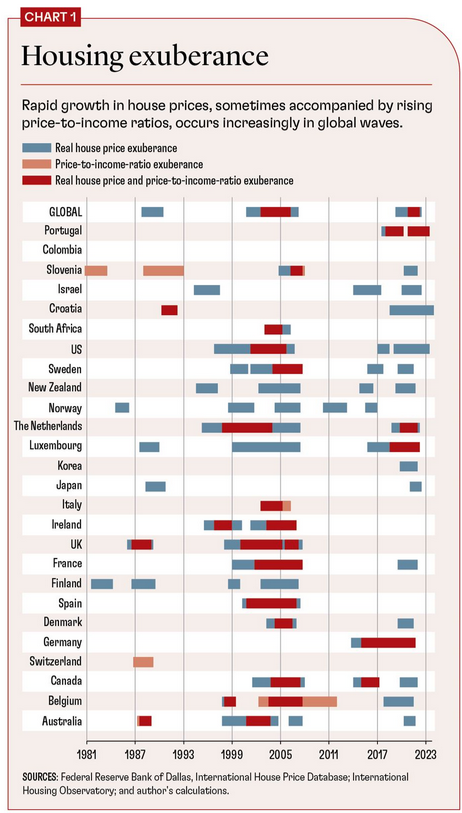

HOW TO STOP HOUSING BUBBLES. Enrique Martinez Garcia – assistant vice president and international group head in the Research Department at the Federal Reserve Bank of Dallas. There’s ‘exuberance’ in housing markets presently but few signs of real ‘bubbles’.

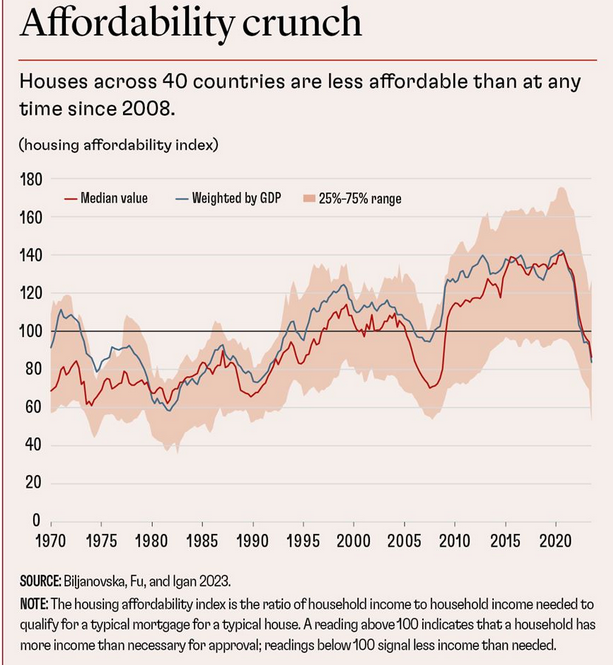

FALLING OUT OF FAVOR. Maria Petrakis – Freelance Journalist. A report on some specifics of the Australian experience. “Ultimately, though, Australia’s housing mess isn’t unique to Australia. “It’s a global housing affordability crisis,” said Kohler. “But each country is unhappy in its own way—and for its own reasons—to quote what Tolstoy said about unhappy families.”

THE HOUSING AFFORDABILITY CRUNCH. Deniz Igan – Head of macroeconomic analysis at the Bank for International Settlements. Governments seeking to intervene in property markets should start with addressing affordability issues.

It seems all’s not right with housing, all around the world and for very different reasons. I can’t help wondering though if, a) it was always thus and, b) what are we supposed to do about it, in reality, anyhow?

Happy Sunday.