I’ve wondered why ‘foreign’ buyers in a housing market, especially if they contribute to higher prices are nearly-always flagged as a bad thing? Surely, I used to think, existing owners get a free-ride benefit, no?

Jung Sakong from the Federal Reserve Bank of Chicago in the paper looked over today has helped me understand the issue in more detail and I think I now ‘get-it’. The study is of the U.S. specifically but the findings are applicable from Jeju to Jersey to Jakarta.

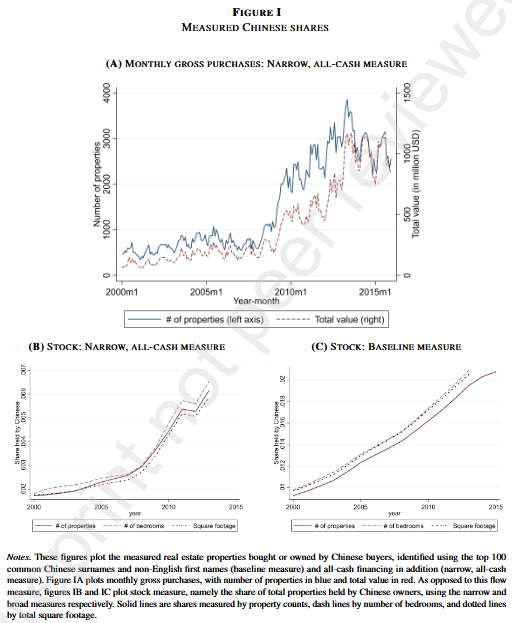

In the U.S. an influx of Chinese buyers was examined from 2000 to 2019. They were particularly busy from 2010 to 2019 when it’s estimated they bought around U$200bn of assets and over the study period their holdings in the U.S. doubled (from a low base).

The paper is a first in that no one, until now, has tried to detail this wave. Helping the researcher is that around 85% of the Chinese population share only 100 surnames. Therefore, an analysis of records that track these names should be fairly accurate. Moreover, the purchases were concentrated in certain counties making granular analysis easier.

This is a highly charged subject so I’ll try and keep to the facts. The main ones being:

- Undoubtedly, where more Chinese buyers appeared, home prices rose as a direct consequence.

- Most of the buyers in the sample were buy-to-let investors.

- Chinese buyers appear to be applying lower discount rates than natives to justify higher purchase prices.

- Rents in the affected areas were not reliably moved up or down. In aggregate though they may have gone down due to a) more rental properties on the market and, b) new building stimulated by higher prices.

To the question as to why owner incumbents are ticked off by the higher home prices; the paper suggests for an owner, all things being equal, higher property prices translate to higher ownership costs. This could be via higher Homeowner Association fess, higher maintenance and repair costs and higher depreciation. Few, if any, of this cohort will attempt to capitalize on lower rents (even if these transpire) by selling up and renting.

As owners account for around 2/3 of the population in America the benefit of lower rents will only benefit 1/3 of the population so the median welfare effect ends up being negative.

I’d chip in here also noting that most renters are aspirant buyers so higher sticker prices for homes in their area would also be a cause of friction/unhappiness with the perpetrators of such a rise.

You can read the paper in full via the following link Chinese Investment Boom in Us Housing Markets.

Happy Sunday.