The latest IMF China Country Report was published on February 4th (the full 84-pager is here IMF China Country Report 220204) and was a generally upbeat summary.

It took a closer look at six topics and below I’ve extracted what I think are the key points from each. In the order in which the topics appear in the report we begin with:

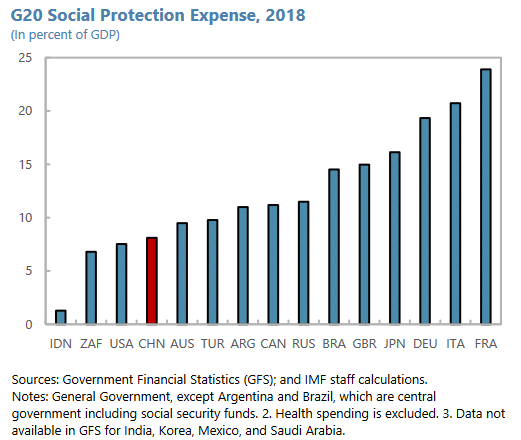

[1] Adequate Social Protection For All

China is a laggard in terms of how much it spends on Social Protection, but it’s interesting to note who they come in just ahead of…

This section concludes: “Social protection is.. a crucial fiscal tool to foster more inclusive growth, support greater labor mobility, and reduce incentives for household precautionary savings. A system with good coverage, adequate benefits, and automatic benefit provision would help rebalance the economy. More economically secure households are likely to spend more on consumer goods and services allowing China to reduce its dependence on carbon-intensive manufacturing, while preserving economic growth.”

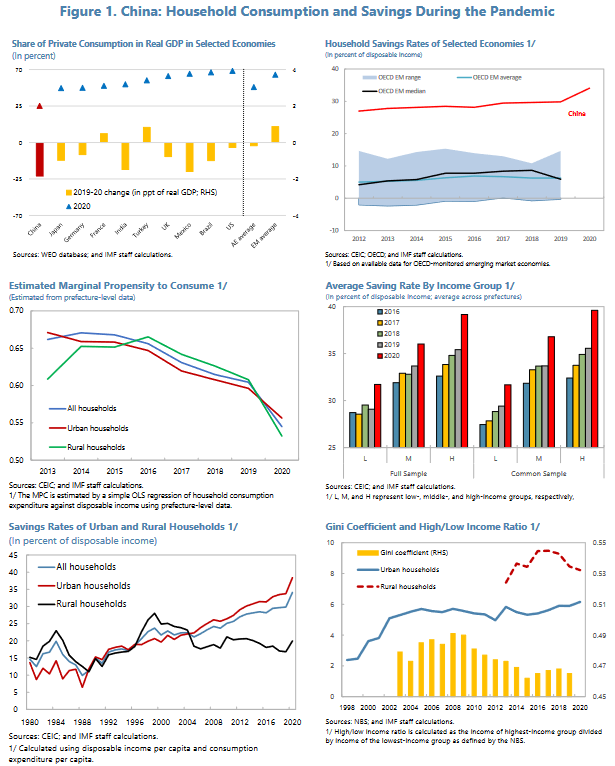

[2] Household Savings and Its Drivers: Some Stylized Facts

The still developing Social Protection infrastructure in China is a contributor to the high savings rate (believed to be a bad thing). A trend which during the pandemic increased..

I know the economic arguments, of course, but I’ll NEVER be convinced encouraging people not to save is a good idea. Here’s part of the summary from the report for some balance: “..there is growing evidence that rising income inequality is harmful for the pace and sustainability of growth.. , mainly through reducing the equality of opportunity and curbing investments in education by the poor and lower middle classes. Reducing the high household savings rate and income inequality is important to achieve balanced and inclusive growth.”

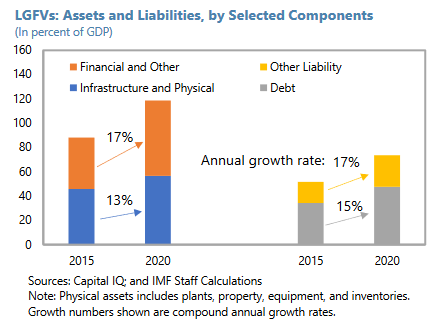

[3] Local Government Financing Vehicles Revisited

These beasts were supposed to have been roped and tied some time ago and thus no longer pose a threat. The analysis suggests otherwise..

Simply trying to rein-in growth here won’t work (and hasn’t, clearly). The fix: “Intergovernmental reforms should be introduced to reduce local governments’ need to borrow over the long term by aligning central government revenue with provincial spending and centralizing some responsibilities in education and healthcare previously shouldered by provincial governments. A sound public debt management legal framework should also be introduced.. This should be complemented by improved reporting systems to provide timely and reliable data on local government debt and extra-budgetary activities. More robust accountability mechanisms, especially audits and proportional sanctions for non-compliance, would also be helpful.” The realist in me can’t help but chime in here with ‘Good luck with all that!’.

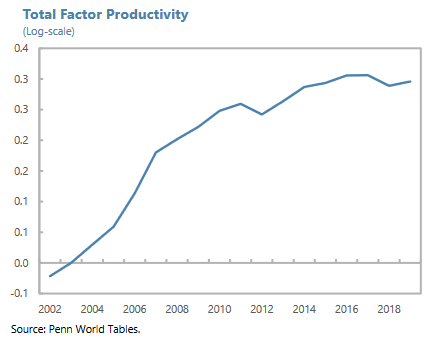

[4] China’s Declining Business Dynamism

This made the most headlines on account of the analysis being consistent with baked-in prejudice and also appearing to be on the money..

Problems here appeared to accelerate post the GFC. From that time China has shown a desire to lean-in more to SOEs and this seems to be the root of the problem. From the report: “a reduction in SOE intensity —such as the one China achieved in the 2000s—could spur young firms’ investments in productivity improvements and market expansion by loosening explicit and implicit barriers that favor SOEs, both in product and factor markets.” Indeed, it could.

[5] Recent Developments and Macro-Financial Implications of The e-CNY

The report highlights significant cross-currents this development has stirred up. It also has a reassuring summary for doomsters fearing this mechanism could be a Trojan-horse for Rmb internationalization.

Videlicit: “..although it [the e-CNY] could help with RMB internationalization given the promised lower transactions costs, its digital form alone is unlikely to have a substantial impact, as the global demand for a country’s currency depends mainly on its economic fundamentals as well as financial market depth and openness, while the RMB or e-CNY is still not freely convertible under the capital account.”

[6] Recent Trade and Investment Agreements and Their Implications for Reform

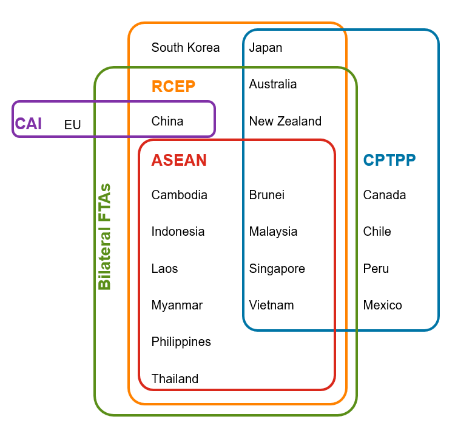

The Regional Comprehensive Economic Partnership (RCEP) is the latest club China has joined and this has significant domestic-policy implications detailed in the report..

Accession to the WTO over two decades ago provides a guide to how China’s participation in these trade groups works for them (very well!). It’s probably only a matter of time now before they’re invited into the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and it’s not all a one-way street: “.. by joining a new generation of regional agreements—the RCEP and, going forward, potentially the CPTPP—China can play a positive role in shaping future international trade and investment negotiations as well as the evolution of multilateral trade rules in the context of the WTO reform discussions.” Ahem! Especially as the world’s largest economy has been such a recalcitrant in this regard in recent years perhaps?

All in all the report details fairly well understood issues and proposes commonsensical and achievable paths forward. Reform though is a marathon not a sprint, but it’s good to be reminded China remains on a steady upward trajectory nonetheless.

My concluding two-pennyworth. Despite attention-seeking-pundits’ best efforts to persistently paint a bleak picture, and shabby politician’s ready willingness to inflate chimeric issues here’s more proof our world really, and in fact, is getting better all the time!

Happy Sunday.