On balance, the IMF give China a clean bill of health in their latest annual assessment. What they’ve chosen to particularly focus on in this report is the ongoing mess in the property market and the concomitant rise in debt at the local government level.

This focus is in line with what we believe China has identified as a priority fix this year i.e. the issue of local government finances. This will be a behind the scenes yawn as far as international investors are concerned but should provide significant long term benefits as and when its done.

Growth is predicted to moderate to 4.6% for 2024 and inflation is expected to, at last pick up, to perhaps 1.3%.

There’s also the recurrent mumble about the need for further SOE reform but I doubt any major progress on that front in the short term.

Below are some of the charts and tables from the report that especially caught my attention:

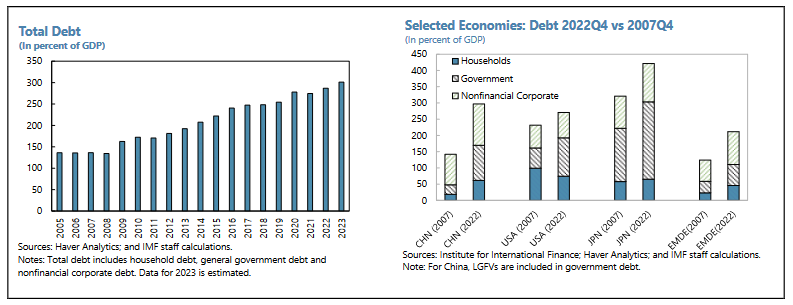

DEBT

This has to be fixed. In China’s case though growth is probably the answer. Others elsewhere in the world may not have that option.

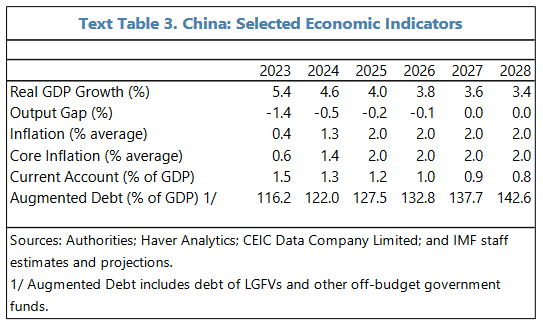

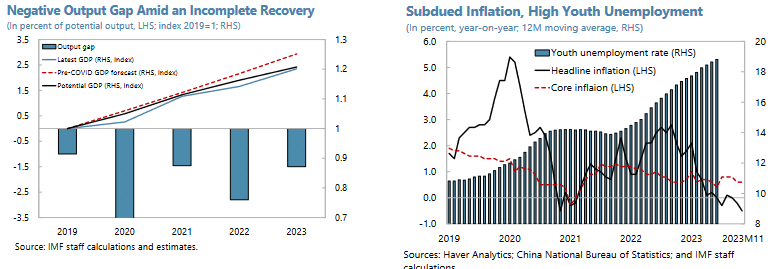

GROWTH

There are two ways to summarize this. Either, growth slows out to 2028, or, growth in the next five years is forecast to be around 21%.

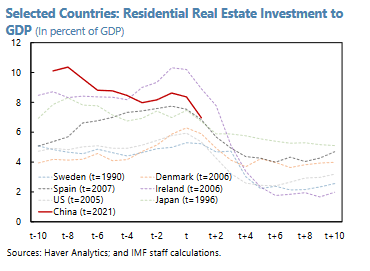

PROPERTY

Seems clear where this is headed. This also shows China’s condition is not only not unprecedented but also how it’s likely to end up.

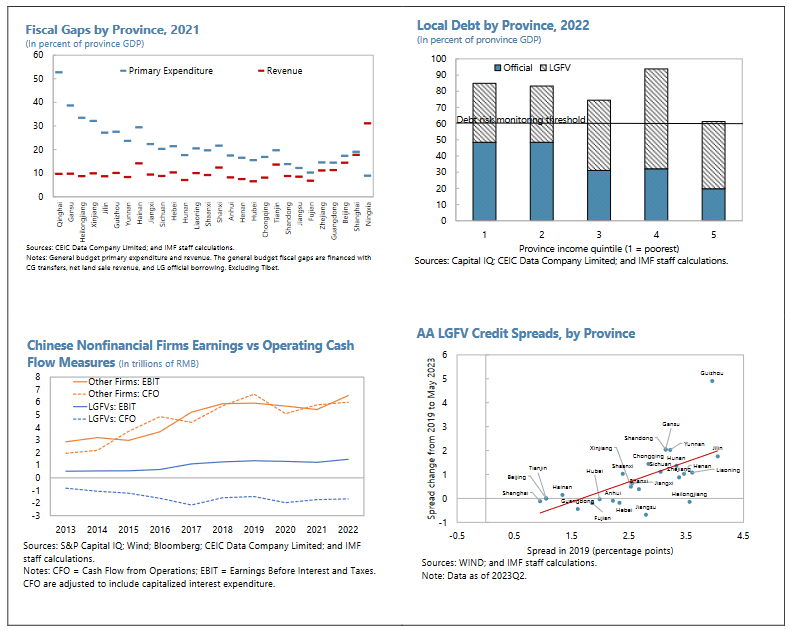

LOCAL AUTHORITY FINANCING

O.K., this also has to stop. A lot of this excess is a legacy of the 2008 stimulus that encouraged local authorities to go their own way.

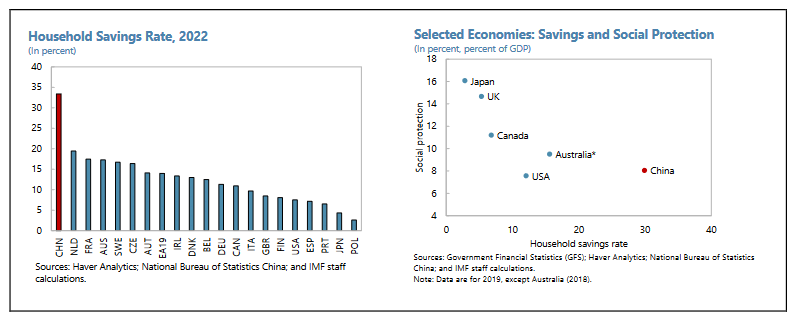

SAVINGS

Too much of a good thing? Is this better expressed as a reverse trust-in-government index? Whatever, it’s too high.

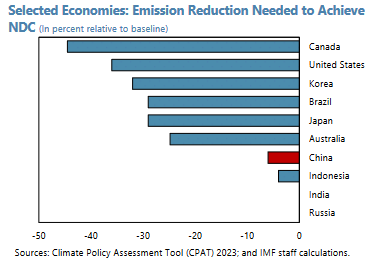

CARBON EMISSIONS

NDC = Nationally Determined Contribution. “China’s NDC includes lowering carbon intensity by over 65 percent in 2030 relative to the 2005 level (shown in chart relative to other countries’ NDCs), and increasing forest stock volume by around 6 billion cubic meters relative to the 2030 level.” Impressive, no?

UNTAPPED POTENTIAL

This can be expressed in a number of ways. However you look at it though, China is capable of much more with its existing resources.

In conclusion the assessment seems to say: ‘Fix the LGFV and related problems, tune up your SOEs, get property off the table of concern and see if you can’t close up some of the inefficiencies in the economy’.

I’ve no doubt China is already busy at work on most of the above; but Rome, as we know, wasn’t built in a day!

You can read the full report (137-pages) via the following link The IMFs Annual China Assessment.

Happy Sunday.