Formally known as the ‘2024 Article IV Consultation’ this annual exercise often reveals more about what’s on China’s planners minds than what the IMF ‘outsiders’ wish for them.

The work was completed in July but the full report was only released on August 2nd and you’ll find it (137-pages) in full here.

Below I’ve extracted some of the more interesting charts/tables:

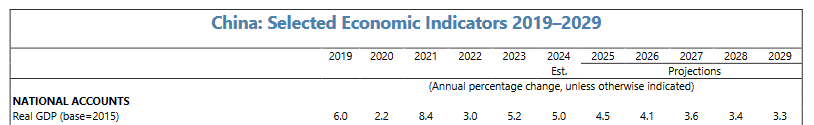

GDP Growth

The IMF concur with the internal assessment that 5% growth for 2024 is likely. Looking further out though they see significant tapering to 3.3% by 2029. That’ll represent growth over the period of 26%. Worth noting that the domestic planners have a higher expectation of medium term growth* (they think 5~6% is possible) than the IMF team.

[*Next week, and possibly the one thereafter I’ll review paper(s) that look at specifics as to how this circle may be squared i.e. what, exactly, China must do to keep the growth pot bubbling on a high heat]

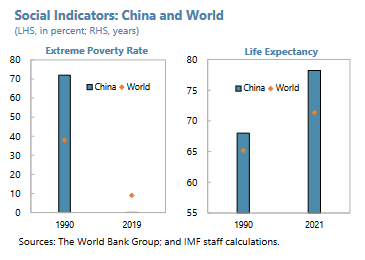

Extreme Poverty? Sorted

Would anyone like to thank the CCP here for this outstanding contribution to human progress, unparalleled in any other developing economy? No? I thought not.

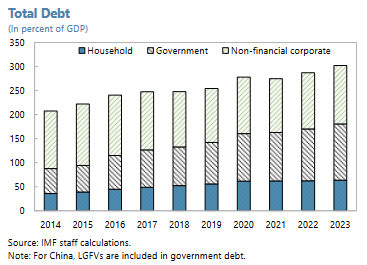

Debt

This has to stop (rising), the authors of the report believe (because, my guess, their contacts told them this) 2025 is the year this finally gets addressed. There’ll be no excuses then.

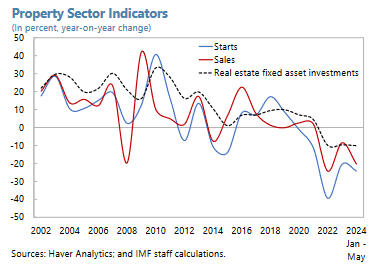

The Property Market

This folly also has to be taken off the table as an existential stability threat. The signs are the government agree and more will be done to right this ship and, more importantly, not perpetuate the imbalance in future.

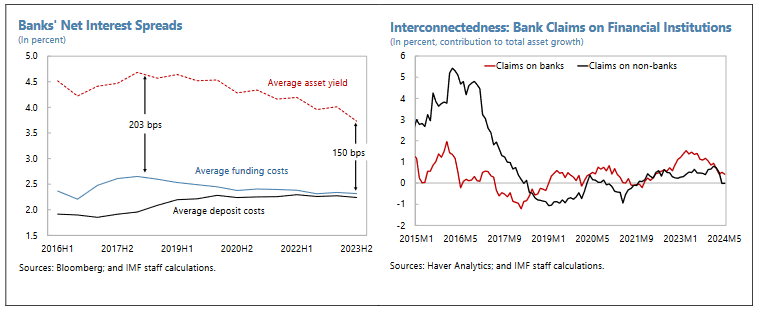

Banks and the Banking System

Assistance to the economy can be seen in the reduction of net interest spreads. This is a piece of elastic that can’t be stretched indefinitely and the current situation probably represents the limit of forbearance. If there are problems its in the smaller institutions. Property has gone from 5% to 6% of NPLs but doesn’t represent a dagger pointed at the heart of the system.

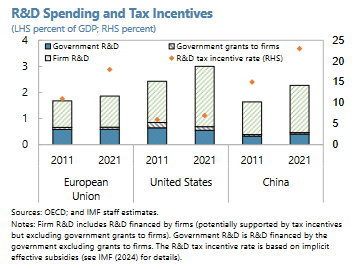

Research and Development

In the big league now, but still with some room to grow. The EU appears to have a problem, both in terms of totals and change over the last decade.

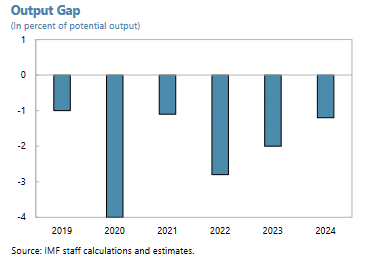

Output Gap

It’s better than it was but the economy is still doing less well than it should./could.

In Conclusion

The IMF conclude the property market is stabilizing, the banking system is in good shape, government and local government financing dynamics will improve in the year ahead but the economy is running below potential.

On this last point they put out a separate report on how “China’s Service Sector Is an Underutilized Driver of Economic Growth” which you can read in full here (It’s a short monograph, well worth the time).

Of all the things you can vex mightily about in our world presently China’s economy, at least as far as the IMF are concerned, isn’t one of them.

Happy Sunday