“Contrary to the conventional wisdom, our empirical analysis indicates that urbanization or speculative demand for housing played [only a] limited role in driving China’s residential investment boom.”

That’s according to economists Ding Ding and Weichang Lian, the authors of the IMF Working Paper highlighted today.

This is an important conclusion; because if the IMF who work closely with China’s policy wonks know this then so too do China’s planners. A more nuanced understanding of what’s behind (or not, the paper gives a longer account of the real drivers) the residential property consumption boom in China is almost certainly informing the policy response now referred to as the ‘Long Term Mechanism’ (LTM).

Missed this? The government have been talking about the need for an LTM for years but only recently has it become clearer what it is (welcome to China!). As it’s currently understood the LTM consists of five elements:

1) an increase in supply of developable land, especially in tight urban areas

2) efforts to increase affordability

3) reduction of structural pressures, such as infrastructure bottlenecks

4) maintenance of prudential mortgage provision and associated markets and,

5) the introduction of a recurrent property value-tax (wait for it!)

Where’s all this going?

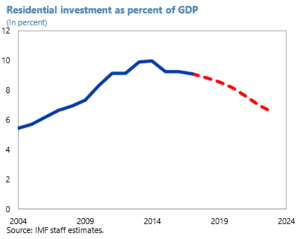

About here, according to Ding and Lian.

Which would be a very healthy development and deflate vexatious chatter that’s been a hallmark of the space for, well, just about ever. Be ye then, worry warts and all, of great cheer? Yes, we/they should.

You can access the paper in full via the following link Residential Investment In China

Happy Sunday.