I especially enjoy it when I find a piece that upends an established view. In this case both my own and the majority of those likely to be reading this.

We all operate on bias, presupposition, prejudice and received wisdom and it’d be tiresome to spend every day in conflict examining one’s intellectual operating architecture. However, when the chance to revisit a bias presents itself, as the work highlighted today does, it should be taken.

Before reading the paper summarized below from Chun Zhou from the Zhejiang University, Wei Zhang and Dan W. Puchniak of the Singapore Management University I held the view that shareholder activism in China was rare and when it did occur the Party was the most likely arbiter of how such conflicts were likely to be resolved. Well, wrong, and wrong again.

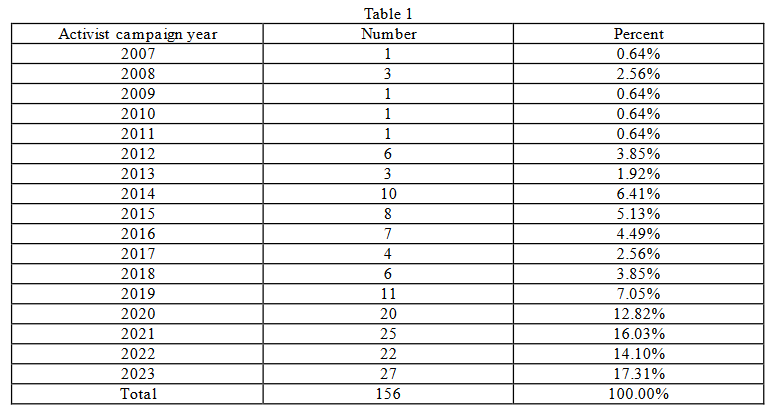

The study of shareholder activism (the world over, not just in China) necessarily lacks rigor because a) the process doesn’t have a reliable definition and, b) a lot will take place behind closed doors. Acknowledging these limitations the researchers took a hand-cranked approach to compiling a database in China, from public records, from 2007 to 2023.

Within this period the team found 156-campaigns. They don’t say as much but I’d add this must be an underestimate of activity. What they then discovered was truly remarkable and I’ll crudely summarize below (practitioners should read the paper in full):

- The process has really taken off in recent years. 2/3 of the campaigns identified have taken place in the last 5-years.

2. The observed success rate for the sample was 47.4%. This compares to an average for Japan of 54.04% and the U.S. of 66.4%.

3.The highest success rates involved cases where a Private Activist Shareholder targeted a State Owned Enterprise. A result at odds with what I, and most others, would have assumed.

4. The counter intuitives keep coming. The study showed “..no statistically significant correlation between the probability of success of activist campaigns and the parties’ relative political power.” [N.B. There are a couple of great examples in the paper]

5. China’s Company Law has recently been amended and from July 1st the threshold for tabling Shareholder Proposals by minority shareholders goes from 3% to 1%. Expect a whole new round of activism to begin as a result.

In summary, shareholder activism in China has been poorly reported in the Western press which is why I and most outsiders just assumed it wasn’t happening, much. In fact there’s been quite a bit and all of it via the mechanism of a rules based system driven by market forces.

With a momentum established and a change in company law about to make it easier expect to hear a lot more about this in future. On the benefits I’ll end with the paper’s cheeky sign off; “There is a reason why the USSR regularly had shortages of toilet paper and why it did not have shareholder activism. China now has an abundance of both.” Let the real fun begin!

You can access the paper in full via this link The Overlooked Reality of Shareholder Activism in China.

Happy Sunday