Researchers at the IMF, Diego A. Cerdeiro ; Parisa Kamali ; Siddharth Kothari and Dirk V Muir in a ‘Working Paper’ for the organization take a look at de-globalization (the euphemism used throughout is ‘de-risking’) and try to calculate what the cost would be if present trends and proposals were more vigorously progressed.

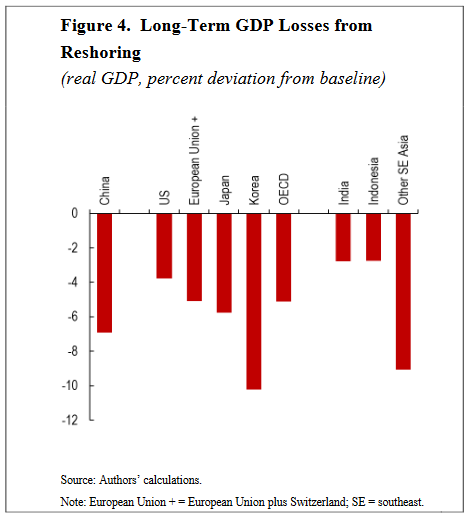

In a nutshell, everybody would be a loser from a complete global re-shoring with only the magnitude of losses moot.

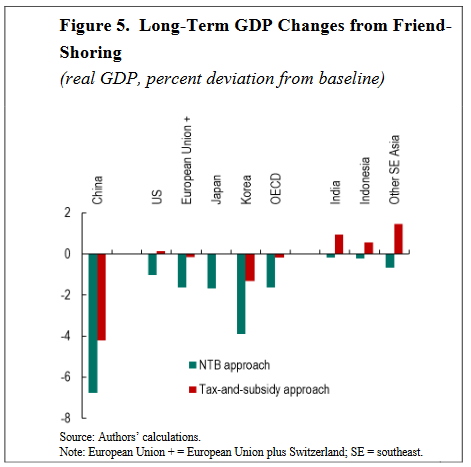

‘Friend-shoring’ would reduce the losses and be a potential net benefit to some; but not all third countries as the China wallop would affect them more negatively than any friend-shoring benefits that would accrue.

What the potential GDP losses also incorporate is the considerable qualitative downgrading that would also take place in this process.

China would get slower AI (huzzah, many might say), but the U.S. and Europe would get more expensive and poorer quality solar panels, EVs and all manner of other products.

The researchers tactfully sum up as follows; “De-risking between OECD members and China can have large negative effects at both the aggregate and sectoral levels, … This underscores the need to prevent any further slide from the current fault lines in global cooperation into broader-based de-risking.”

Or, could the world’s governments do anything more completely barking-mad than to carry on on this path?

The paper in full is here The Price of De-Risking.

Happy Sunday.