How many times do we hear ‘Chinese buyers are pushing up property prices’ in Manhattan, Sydney, Cheju, London or wherever? But is it true? Do flows of money from Chinese buyers really and noticeably affect real-estate prices in certain areas?

In the first study of its kind (I’ve seen) to isolate ‘unofficial’ Chinese capital flows into real estate researchers from the Division of International Finance at the U. S. Federal Reserve Board looked at the U.S. from 2010 to 2016 and conclude, indeed, they do.

By how much? Er, quite a lot: the analysis found that “..house prices in major U.S. cities that are highly exposed to demand from China have on average grown 7 percentage points faster than similar neighborhoods with low exposure over the period 2010-2016.” Which is quite a lot.

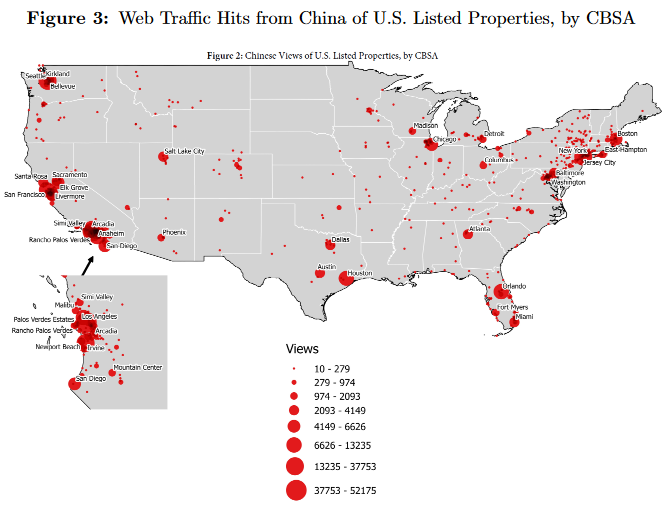

Areas of interest are pretty much what you’d expect and the illustration below shows how the U.S. looks in terms of where web-based interest has been shown from China.

Another stand-out from the research is when the effects were most keenly felt. Interest from China (HK flows are included in the same pot) seems to increase when the Chinese economy is stressed.

Moreover, these real-estate-related fund movements seem to correlate with macro-flows so the public data data on those should, in future, be a useful gauge for the ‘shadow’ flows that will most likely be coincident.

Bottom line. We know that Chinese capital forms a significant component of the U.S. Inc. balance sheet via government bond purchases and FDI. Add to those numbers the unofficial flows into U.S. real estate and the Chinese and the U.S. economies are revealed to be progressing an even more significant, and ever closer, union.

Not what many perhaps, on both sides of the Pacific, would like to hear?

You can access the paper in full via this link China Demand for U.S. Houses.

Happy Boxing Day.