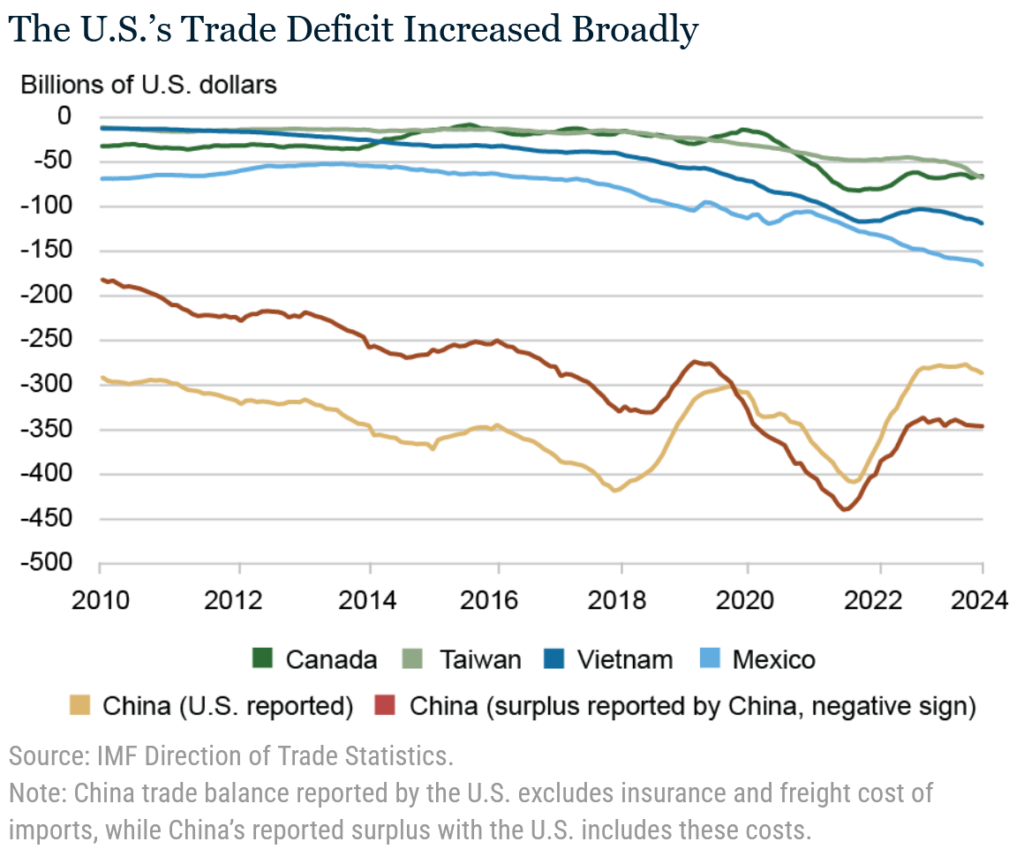

Since the first Trump tariffs were introduced against China America’s trade deficit has increased, both with China (depending on how you clock the data) and many other partners. However, the way America calculates the numbers shows a win in terms of a falling deficit with China.

Whether the trade deficit with China has risen, or fallen is an important consideration in terms of how one should expect new tariffs to work.

In a post at the New York Fed’s Blog ‘Liberty Street Economics’ Hunter L. Clark highlights the discrepancy that’s opened up since around 2019 (where the tan and the red line above cross) between what China thinks it exports to the U.S. and what America believes comes in.

The big difference is all those packages from Shein, Temu and others that have fallen under the U$800 de minimis rule. China counts these bundles of joy but America (at least as far as adding them to the trade data) doesn’t. Since that trade has rocketed the not adding them into the overall numbers has resulted in this obvious, large and systematic error.

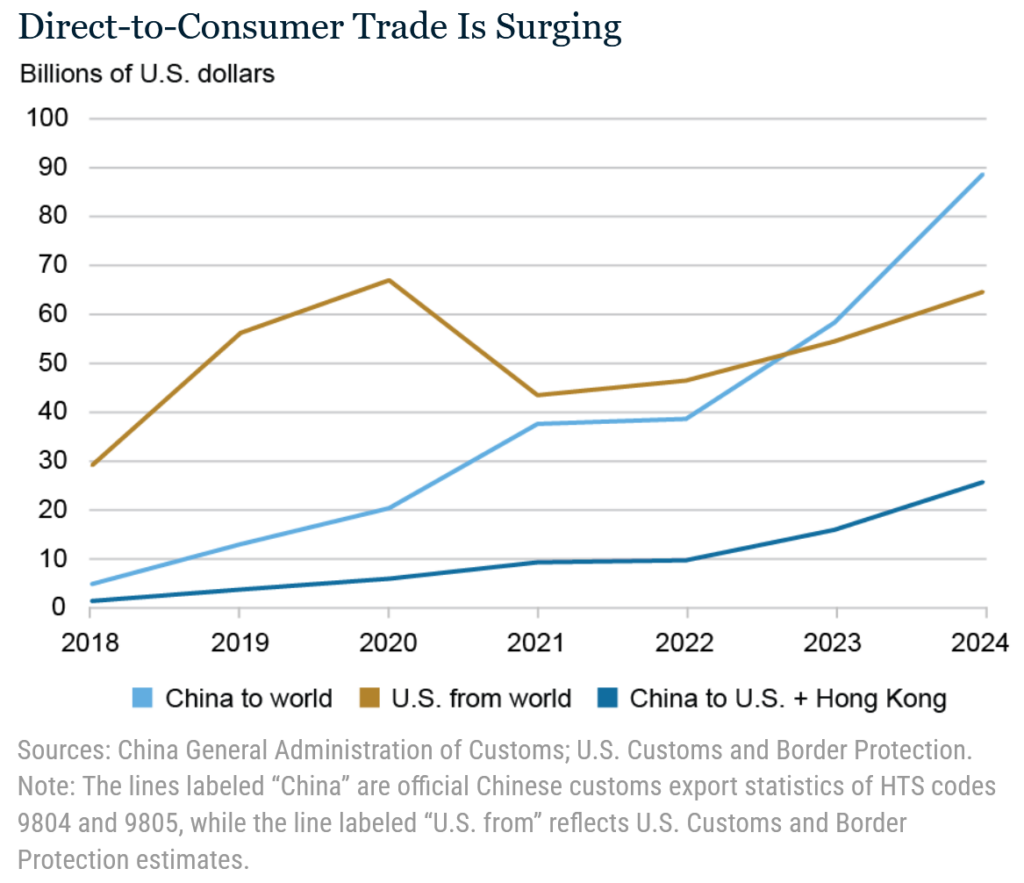

China tracks this direct sales trend and the U.S. collects data even if it doesn’t include it in its trade accounts. As you see in the chart below the growth in this segment in recent years has been explosive.

Why is all this important? If China trade is much bigger with the U.S. than planners have figured then the effect of new tariffs, especially the cancelling of the de minimus exemption, could have a much greater effect on U.S. consumers than many are now expecting.

As every investor knows, past performance is no guide to future returns, and it may be the case here that an ineffectual past tariff policy is about to be followed by one that ends up delivering a swingeing blow to consumers that few are now anticipating.

You can read the full post here U.S. Imports from China Have Fallen by Less Than U.S. Data Indicate.

Happy Sunday.