‘For whoever has will be given more, and they will have an abundance. Whoever does not have, even what they have will be taken from them.’ (Matthew 25:29)

Those words from the Bible would work as a two line summary of this document just published by the United Nations Conference on Trade and Development (UNCTAD). The good news is that global FDI in 2015 was U$1.8bn, up 40%; a post GFC high. The bad news is that if cross-border M+A is stripped out and we concentrate on ‘real’ investment the growth number is a less impressive 15%.

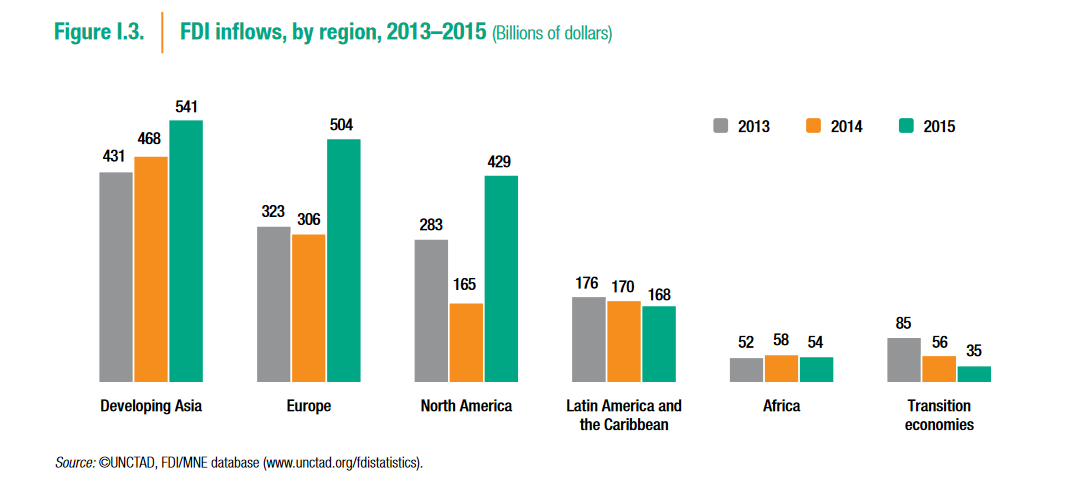

The good news for investors in this part of the world is our neighborhood maintained momentum as the world’s most preferred destination for FDI. The bad news is for just about every other developing part of the world flows were either broadly flat or in many cases down, especially where commodities are a big part of their economies i.e. Kazakhstan.

The mixed picture continues with the authors of the report predicting a global retreat in FDI of 10~15% in 2016 based on a Multi National Enterprise (MNE) survey response. It should pick up after that but will only return to the 2015 level by about 2018.

The mixed picture continues with the authors of the report predicting a global retreat in FDI of 10~15% in 2016 based on a Multi National Enterprise (MNE) survey response. It should pick up after that but will only return to the 2015 level by about 2018.

China investors will be pleased to learn that in 2015 FDI into the services sector accounted for 61% of total investment, a new high. More evidence of China’s pivot to services. It was also noted that China, behind only the U.S. and Japan, is now the world’s third largest overseas investor.

The report also riffs on the increasing need for global coordination on tax issues pointing out that in a sample of MNEs from 25-developed countries more revenue was recognized last year in Bermuda than China [!?].

Finally, (and only for the very keen) the report devotes a lot of space to the need to rethink issues of nationality in our increasingly complex world when it comes to restricting or preferring investment. MNEs, via multi-layered holding company structures, now have the ability to morph into whatever form they find most advantageous in a particular jurisdiction. 19th century notions of nationality therefore need to be rethought in our ever more complicated globalized economy.

You can access the report in full with this link UNCTAD World Investment Report 2016.

Happy Sunday.