Jeff Dawson, an international policy advisor in International Studies in the Federal Reserve Bank of New York’s Research and Statistics Group has written a useful piece in the Bank’s blog ‘Liberty Street Economics’ on this topic of concern to all of us at present.

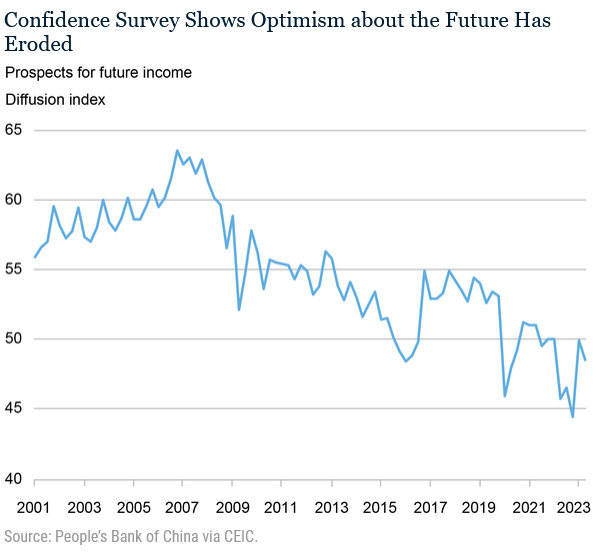

China needs to persuade its citizenry to spend more, and this has been the case for a long time. So far though, old habits are taking a long time to die. Moreover, ‘confidence’ about the future seems to have been in a long term downtrend from which no recovery, so far, is clearly discernable.

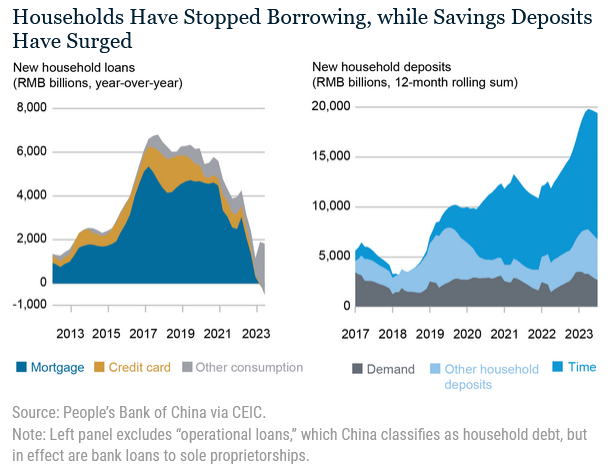

Property market turbulence in the last couple of years is one explanatory variable for the above. This has not only eroded confidence but triggerd mortgage loan repayments and an increase in precautionary saving. Factors not normally associated with expanding economies.

He concludes “With problems in the property sector likely to be protracted and direct support for households not traditionally part of Chinese authorities’ playbook, policymakers face a tall task of reversing households’ attitudes about the future that will be key to bolstering consumption and reviving economic growth momentum.”

My own two pennyworth is to note that Mr. Dawson is highlighting one dimension of the bigger problem of a citizenry presently experiencing something of a trust-defecit with their rulers.

This will have to be fixed and I’m confident its high up on planners To-Do Lists. The time for policy ‘adjustment’ is coming to an end and something demonstrating a greater sense of urgency, and from the very top, is somewhat overdue, IMHO.

You can read the article in full here Why Are China’s Households in the Doldrums?

Happy Sunday.