Summary

Sentiment towards China stocks is improving. A closer look at trend components suggests the momentum is likely to persist.

Preamble

Throughout this note I’m going to use stock prices as a sentiment-gauge acknowledging they’re far from perfect; but they’re not that bad either.

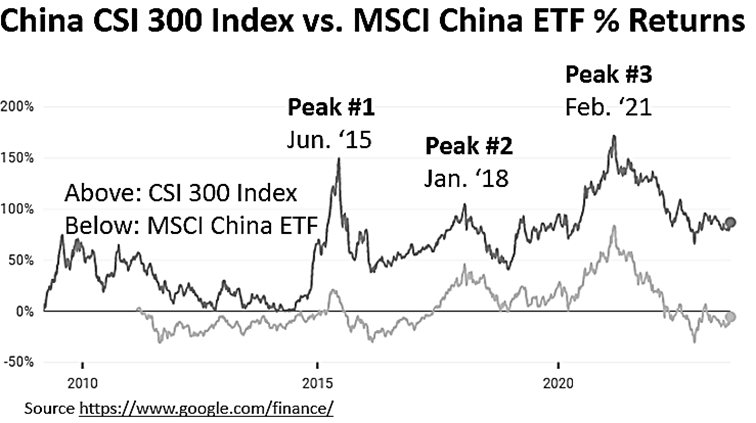

A rough guide to how non-domiciled investors have fallen in, and then out, of love with China in recent years can be viewed via the MSCI-China Index comprised of the prices of China’s largest investable stocks.

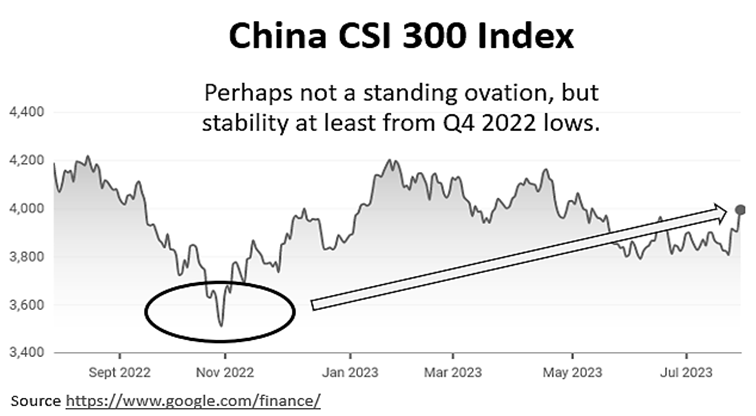

Three rallies in the last decade stand out with average duration and returns of 26-months and 87%. The rally begun most recently by comparison, in October 2022, has progressed now for nearly 10-months and bottom-to-last produced a return of just under 40%.

Domestic investors have experienced the same cycles but fared better over the period. Neither group though has done well in recent years and both groups hold stocks with prices far off period-peaks.

The purpose of this introduction is not to parse history but to remind when sentiment changes direction it proceeds in the new direction for some time and takes stock prices a long way with it.

Sentimental Journey

Picking sentimental turning points is impossible but luckily we don’t need to do this presently. It’s clear an inflection occurred sometime late last year and from that point sentiment towards China stocks has been improving among both the domestic and overseas investor community.

The bigger question now is ‘will this process carry on?’

To attempt an answer we have to go back to the inflection point in Q4 last year and look at what factors then were, a) depressing sentiment and, b) what the trend since then has been for each of those specific negatives.

Seven issues were most acutely bearing down on sentiment late last year. In the interests of brevity I’ll just sketch them out below. Besides, we don’t need to get into the why of any of them, we just want to know what they were and how/if they’re changing.

Peak Pessimism – Q4 2022

The following were the main drivers of investor pessimism that took China stock prices to new lows in Q4 last year. They were, in no particular order:

Official antipathy to the private sector and new-economy operators was believed to be a condition that might continue indefinitely. This led to the stock price weakness of many large companies and the indices which they dominate.

U.S. China relations hit a new low following the visit by U.S. House Speaker Nancy Pelosi to Taiwan in early August. China’s subsequent war-gaming of a Taiwan blockade then accelerated a blaze of speculative chatter concerning invasion.

The COVID response. The mood of citizens soured in Q4 last year as it became clear it was time for an exit. Protests in November provided a wake-up call to planners, produced ugly optics and profoundly scared foreign investors.

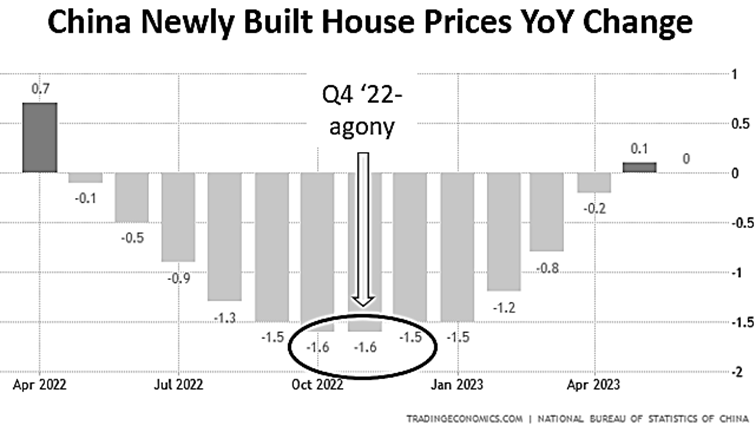

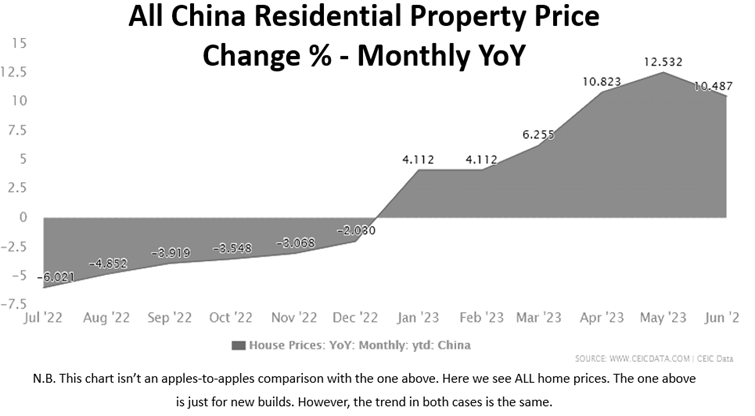

The property market was in free fall. We can see now it was a bottom but investors at the time had no sense of a way out.

Leadership was absent. China works, mostly for good, via a highly centralized system. The benefits of this were clear in early-COVID but by Q4 last year, unable to pivot, leadership seemed to absent itself. This was a baffling and worrying development.

The citizenry were very, very brassed off. See most of the above! We know there were protests in Shanghai because international media caught them. These were almost certainly just the tip of an iceberg of broader public frustration with their lot and their leaders.

The world was a depressed place. We see this in the S+P-500. It was agreed by most at that time recession surely lay ahead for many Western economies in 2023. We now know what’s actually happened, but in Q4 2022 this surprisingly benign scenario wasn’t being discussed.

Forward To Growing Confidence – Q3 2023

A review, below, of the negatives above will remind in how much better shape we’re in today, in fact, than we feared we‘d be back in Q4 2022:

Government policy with regards to the private sector. A multi-year hack into new-economy operators is over. Recent remarks from top officials have also stated a specific desire to foster entrepreneurship and all forms of private initiative.

U.S. China Relations. Bill Gates, Jamie Dimon, Tim Cook, Anthony Blinken, Janet Yellen, Henry Kissinger, the list goes on of high profile American business and political leaders who’ve visited China in the last few months. Enough said.

COVID. China is still dealing with new cases, the exit from the containment strategy was a mess and some heads will, quietly, roll; but the worst of the pandemic and China’s fumbling back-end response is surely behind us.

The property market has stabilized. In a document published last week following a key Politburo meeting an important and supportive change of policy with regard to the sector was made made plain. Stability isn’t recovery, but the free fall is over.

Leadership. From the same Politburo dispatch noted above it was clear not only are the government, again and at the highest level, laser-focused on the economy but also by implication the President Mr. Xi Jinping is personally leading the effort.

Confidence in leadership has improved. We know this how?

The global macro environment. The world’s largest economy is straining at the leash, employment trends across the developed world are almost unbelievably good and corporate profitability is robust. This is not the world we thought we’d be living in six months ago.

No Going Back

Having looked over the factors responsible for Q4 2022 lows and noted the condition switches from malignant to benign we can return to the question of trend endurance.

Some questions are more easily answered when flipped. Instead of ‘will benign factors driving favorable sentiment persist?’ we could as easily ask ‘why would any benign factors currently driving sentiment not persist?’

Sure, one or two might melt away in time, the force of others may weaken, but it’s impossible to imagine a scenario where all would return to the negative condition prevailing in Q4 2022.

In Conclusion

That we’re at an inflection point from which a new trend towards serial pessimism begins is, of course, a possibility; but it’s one to which we can assign a very low probability.

More likely is that the present trend persists and domestic and foreign investor sentiment towards China-stocks continues to improve along with the factors responsible for that improved mood.

Which implies China-stock prices too will continue to trend higher.

Nial Gooding CFA

Monday, July 31st 2023