Preamble

A few years ago there was a craze for ‘do-it-with’ jokes. Only the very naive would have failed to recognize do-it as a none too subtle euphemism for, well, doing it. This produced some quite amusing one liners. Organization theorists do it loosely coupled, for example; and some really sad ones. Monte Carloists do it randomly? Oh dear.

To my point. China’s stock markets have been on a tear recently and that’s making people nervous. A quick look at where valuations have been and now are though may help to calm some of those nerves.

Summary Conclusion

Hong Kong listed China shares one year ago, when the HSCEI was 10,080, were trading on an e2016 P/E of 5.7x. Today, with the HSCEI at 14,800, they’re on an e2016 P/E of 8.4x. Yup, that’s quite a shift; but still cheap versus other major global markets.

The key point, for those of us who’s shingles read ‘I do it with numbers’ is that just as gone-down-a-lot is never the same as cheap, gone-up-a-lot is not the same as expensive.

China’s Stock Markets – What a Racket!

Not helping clear analysis is the proliferation of China’s stock markets and their seemingly endless sub-division by analysts and commentators. When we hear a reference now to ‘China Stocks’ what is it that’s being referred to? Shanghai As? Shenzhen’s ChiNext? The Hang Seng Index? The Hang Seng China Enterprises Index?

This is a commentators dream. Poor journalism begins with a headline and then finds copy to support it. So, want to write about fresh highs? Pick a market. Record volumes? Take your pick. Reversals of winning streaks. Easy. The net effect of all this clack though is to obscure and confuse the only argument investors should care about; value.

To Be Fair..

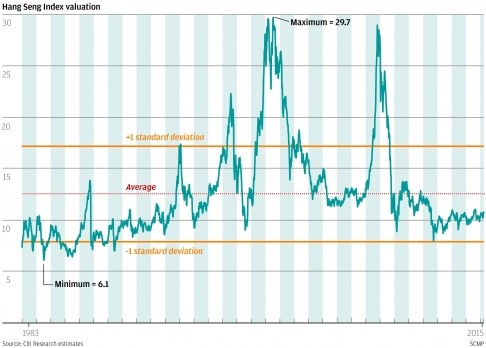

I came across this chart in the South China Morning Post last weekend and I hope they and Citibank won’t mind my reproducing it again here?

This is the Hang Seng Index P/E going back to 1983 and shows where we are and where we’ve been in the last 30-years in valuation terms.

Immediately obvious is we’re presently a long, long way from fully cooked in terms of stocks listed in Hong Kong.

I make no prognostication about what the ‘right’ level for stocks might be but what I can say is compared to historic precedent they appear still to be south of an average, which is just another way of saying they remain cheap. That’s not an opinion; that’s just what the numbers say.

In Conclusion

This is a short note because it’s a simple and self evident point. Those nursing nose-bleeds due to the recent rapid ascent should bear in mind that an element of dazed and confused is perfectly normal in the circumstances. This is surely a time for taking stock; but it is most certainly not a time to be checking the exits.