The Chinese currency (Rmb) doesn’t free-float against the U.S.-Dollar (U$), it goes where Chinese planners want it to; and recently that’s been up. Two years ago 1-Rmb bought 14.5-U$ cents, today it buys 15.7-U$ cents which is a strengthening of around 8.5%.

What’s the fundamental economic rationale for this move? Why have the Chinese authorities accommodated it and what might they like to see as the next iteration? First, a look at the fundamental driver.

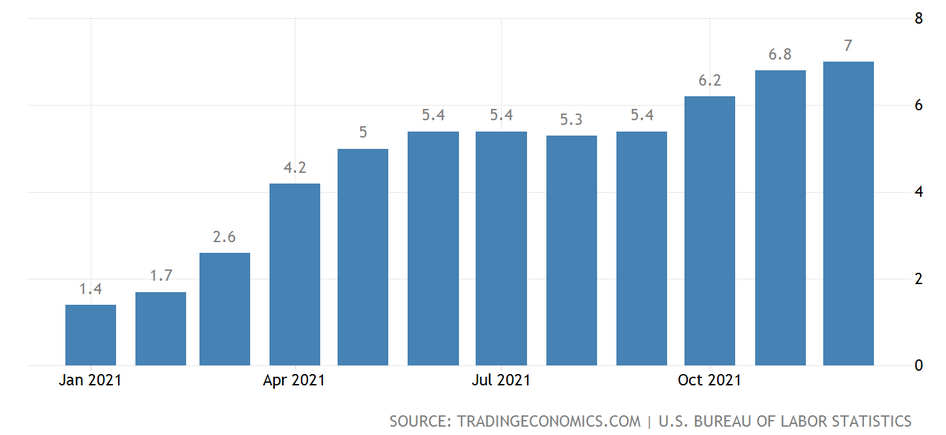

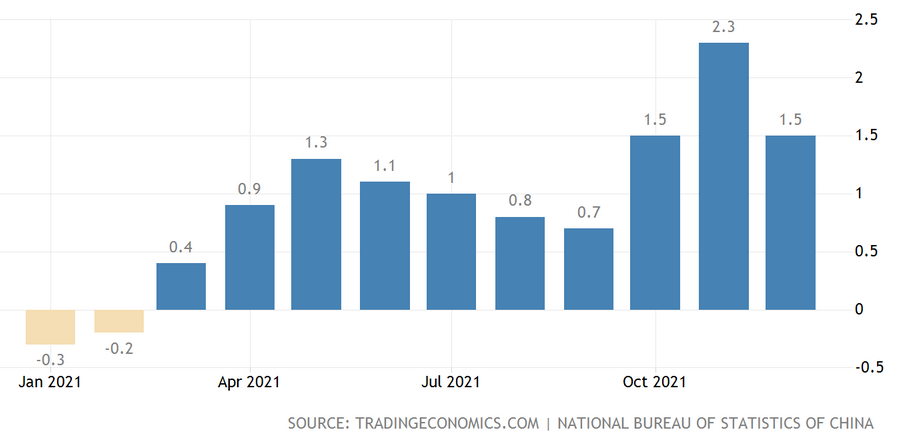

Over the last two years the American monetary-policy response to COVID has been profligate. This approach should, according to classic economic theory, have resulted in an inflationary surge. Which it has.

China’s monetary-policy has, by comparison, been parsimonious. This approach should have prevented an inflationary bump and, as we can see, it has.

One government’s policy is therefore deflating the monetary value of assets denominated in its currency, the other’s is not. These different inflationary paths will have encouraged investors to accumulate Rmb denominated assets, for which they’ll have needed to purchase Rmb.

China’s authorities have probably calculated there’s no reason to stand in the way of this natural-in-the-circumstances desire and so have allowed the cross-rate to drift up to reflect it. So far, so reasonable then.

But what next? Does the trend persist, stall or reverse? The un-intervened natural-drift continues to favor further Rmb strength (absent the United States running it’s inflationary problems quickly to ground); but would a yet-stronger Rmb be to China Inc.’s advantage?

If not planners may sit on the rate at current levels; but if further strength were advantageous they’d likely continue following Ms. Markit. So which is it?

A controlled, modest, further appreciation of the Rmb would be in China’s best interests for the following reasons:

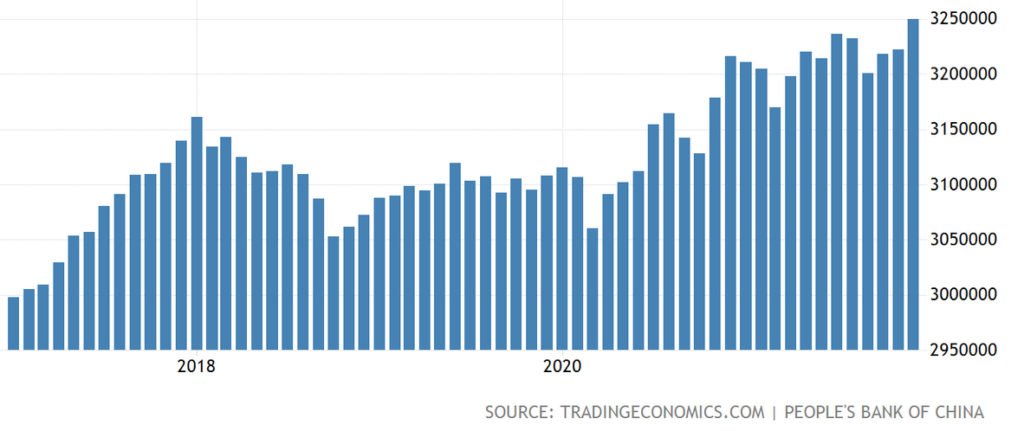

1. It’d keep capital at home. Remember a few years ago forex reserves were dwindling and Chinese businessmen were scouring the world for non-Rmb denominated assets? This was a worry; but no longer.

2. It’d encourage manufacturing efficiency and higher value add. China isn’t going to make the Japan mistake that led to the forced-appreciation of the Yen in 1985. Tin-toys and textiles are a way forward, not up.

3. It’d balance monetary easing. As Western economies wind in balance sheets China has to go the other way and expand credit. An appreciating currency in this process would help keep inflation in check.

4. It’d keep imported inflation tame. There is a specter haunting the World, the specter of inflation. An appreciating currency is a natural omnidirectional defense against this.

5. It’d ease pain for private sector borrowers with foreign currency debt. At the governmental level it’d hurt a little as forex reserves will be debased. Net-net though it’d assist overall domestic financial stability.

6. It’d promote national feel-good, always a desired outcome for the CCP. Moreover, outbound tourists, now a large percentage of the population, would be tangibly better off when overseas travel begins again.

In conclusion, a natural trend towards Rmb strength will continue due to divergent inflationary and monetary policy trends. China’s planners are likely to view this favorably and allow market forces to take their course, at the same time, steering the Rmb gradually higher to reflect them.

Nial Gooding

Monday, January 17th 2022