Preamble

In April I posed the rhetorical question ‘Dare We Be Bullish About China?’ [Dare We Be Bullish]. Then, I concluded, the answer was no. That note was a follow on to another written in August 2014 when economic indicators were pointing to a rapid deceleration of economic activity and some sort of hard economic landing [China Hard Landing].

The hard landing came although, this being China we found a politer euphemism, and ‘New Normal’ was shortly afterwards widely acknowledged. By April this year though signs the economy had bottomed were evident; but they were feeble and hence it was too early for fresh confidence.

Summary Conclusion

Yes, we can now dare; to be, cautiously, bullish about China.

As I’ll argue below a non-partisan reader of economic data would now agree the economy is no longer weakening; in fact, its improving. There is of course no short-term relationship between the health of an economy and stock prices. If, however, the economy has turned a corner stock prices will, in time, reflect this.

I’ve argued for a while Hong Kong listed China stock valuations are significantly below what reality would suggest is fair; but if that reality is now improving the chance of a revaluation ‘double-whammy’ (of which more later) showing up in stock prices is increasing.

Let’s look in more detail at improving trends. Starting not with an economic observation but the ever present 800lb gorilla in the room..

Politics

Or first, to be more precise, the anti-corruption campaign. Begun in 2012 it’s been widely aired that a desire by officials to keep head’s down has led to sclerosis in certain parts of the economy. We confirm this from our own network and the relevant question now is; when will this campaign end?

Corruption will never be tolerated so it’ll probably officially never end; but there are signs it’s running out of puff.

The graphic here only brings us up to the end of August but does suggest the campaign is, at least, no longer accelerating.

Elsewhere , over the first four years of his Presidency President. Xi has been enthusiastically collecting titles culminating recently in perhaps his last acquisition, that of ‘core leader’. This puts him now in a commanding position to bump proteges of former President Jiang Zemin (the last leader to flirt with the core title) at a major reshuffling of key players due at the 19th Party Congress next fall.

Chinese politics is a black box but what’s clear is President Xi has strengthened his position, the anti-corruption campaign has almost certainly peaked and while the former may be just a neutral for the economy the latter, if true, would surely be a net benefit.

Now some economic indicators.

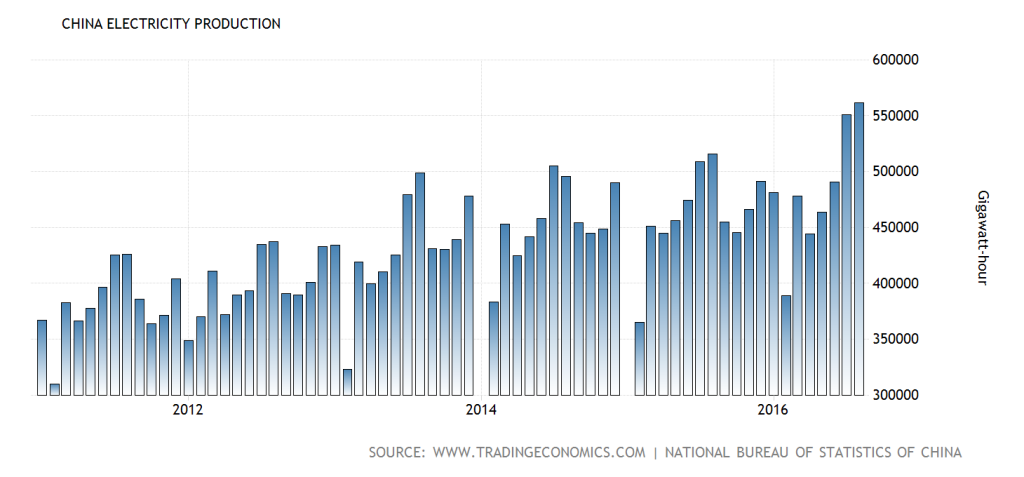

Electricity Production

In a growing economy this chart should always slope up to the right; but what’s interesting about progress in the last few months is the rate of change.

The production numbers are matched by data for consumption which was up 4.8% for the year to the end of October. That’s versus a rise in consumption last year for the same period of only 0.8%.

As a very rough rule of thumb electricity demand tends to rise at around half the level of GDP growth so what do these numbers indicate about the broader economy?

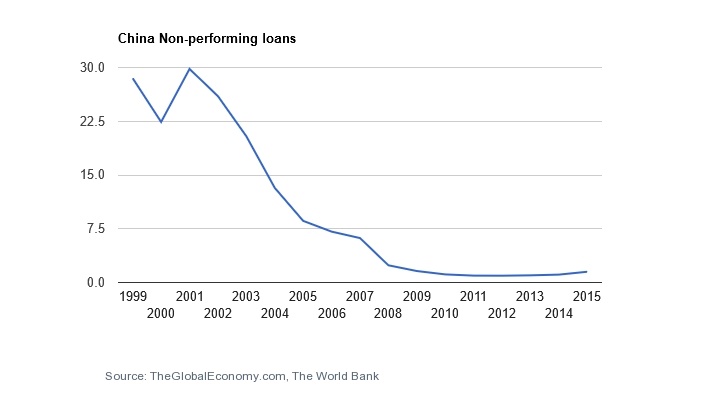

Problem Loans

China banks in aggregate had an NPL ratio at the end of H116 of 1.8%. Look at the chart and see how that compares to the past.

Not scary compared to history nor particularly scary if compared to end 2015 numbers from the World Bank for other countries e.g. Japan 1.6%, India 5.9%, France 4%, U.S. 1.5%, Brazil 3.3% or the Russian Federation 8.3%.

Not scary compared to history nor particularly scary if compared to end 2015 numbers from the World Bank for other countries e.g. Japan 1.6%, India 5.9%, France 4%, U.S. 1.5%, Brazil 3.3% or the Russian Federation 8.3%.

Yes it’s ticked up a bit; but not by anything near what it was tipped to have ripped to by analysts not long ago.

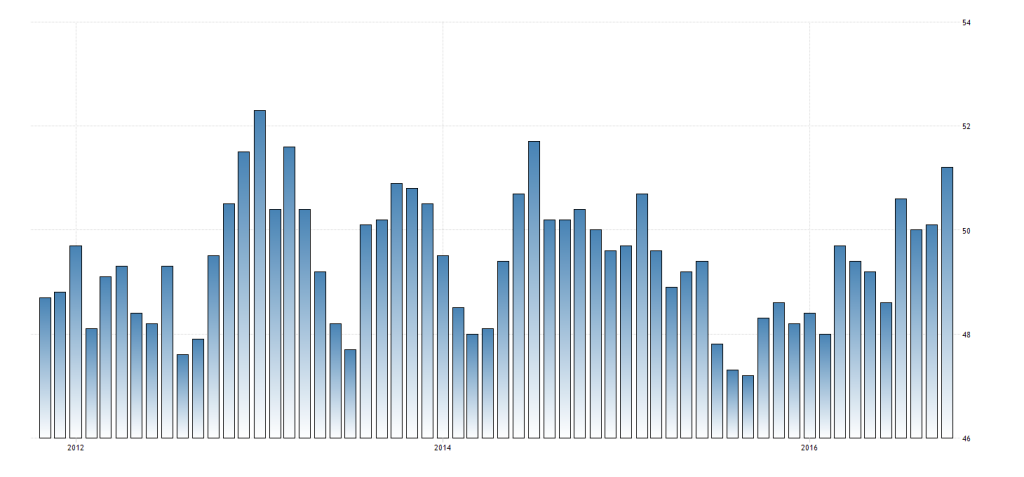

The Purchasing Manager’s Index (Manufacturing)

As the economy re-balances this will become less relevant; but its still more closely watched than it’s counterpart for the services sector (which is showing considerably more strength).

The absolute level isn’t the story here so much as the momentum. Look where it’s come from a year ago (the bars are monthly with the last being October).

The absolute level isn’t the story here so much as the momentum. Look where it’s come from a year ago (the bars are monthly with the last being October).

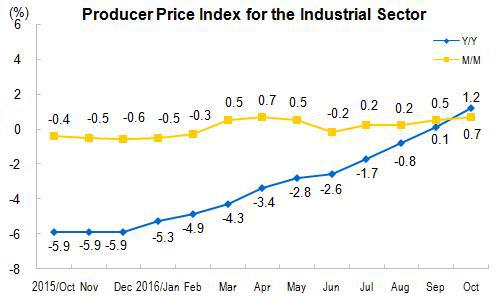

Producer Prices

This picture can do its own talking.

Other Bits and Pieces

Rail Freight Volumes; up in October for the third month in a row, having fallen for 32-straight months before the pick up in August.

Excavator Sales; up 71% in September YoY and 25% MoM. Auto Sales; +20% in October YoY, up 15.4% for the first ten months.

GDP; reported stable and unchanged from Q1 and Q2 in Q3 at 6.7%.

Industrial Production and Retail sales; latest readings for October +10% and +6.1% YoY respectively. Deemed slightly disappointing but, please, show me better elsewhere in the world?

Throw in rising steel, coal, chemical, home and even garlic prices and a fair description of any other economy showing such trends would be ‘rude good health’. Somehow more is always expected of China. So lets just agree the above doesn’t suggest a further contraction or fall in overall economic activity?

Revaluation Double-Whammy

My argument, until now, for China stocks has been a version of the long term valuation mean-reversion case. What if earnings growth could be added to this argument though?

If a general mood shift were to take place in favor of China, based on the observable improvement in fortunes highlighted above, there’s scope for not just one revaluation of China stocks but two if earnings gains are stirred into the mix.

An example: Stock A, which I may believe can produce a steady annual EPS of Rmb10 is trading at Rmb50. It’s P/E is therefore 5x. Stocks in the same industry elsewhere in the world trade on a P/E of 15x and it’s own long term average P/E has been around 10x.

So, I calculate upside to a ‘fair’ valuation of 100% if it’s P/E is to return to the long term average of 10x i.e. it goes from Rmb50 to Rmb100; but what happens if earnings and what’s deemed an acceptable valuation level simultaneously rise?

Factor in earnings growth not of zero but perhaps 10%, and the fair valuation is deemed not 10x but, say, 12x? The stock now would have over 160% upside [(EPS Rmb10*1.1)*12 = 132, 50/(132-50) = 164%).

This is how a bull market works; and it’s always a surprise (especially to sell-side analysts!) when this process takes off.

In Conclusion

Not because I feel it in my water, nor because I’m tired of playing defense for the China team; but because facts compel me to acknowledge a changed economic environment I find myself, for the first time for quite a while, cautiously bullish on near-term prospects for the Chinese economy.

What hasn’t changed is my long-standing argument about the valuation of Hong Kong listed China stocks reflecting not even a moribund economic backdrop; and their yields being fine compensation for patience in anticipation of fairer valuations. This is still the case and the most compelling argument for engagement.

To this argument now though I’m adding another line; ‘..and the possibility of rises of earnings and valuation expectations are currently not factored into stock prices.’

Thus, a valuable but presently free option is on offer in addition to the base-case value proposition. Does anyone need reminding? Free anything doesn’t hang around long in markets.